SoLo Funds is designed to provide emergency loans quickly. Though the startup offers the promise of financial stability, the reality is a bit more complicated. Apps like SoLo Funds don’t carry the same deceptive nature as high-interest payday loans, but they can still be very dangerous.

Moreover, most of the lenders found that the majority of people were late paying back their loans, with many of them not paying them back at all.

In this article, we will take you through 12 apps like SoLo Funds for both Android and iOS which you can use to lend or borrow money.

SoLo Funds

As used by millions, SoLo gives you the freedom to borrow money on your own terms or lend and profit from the interest or benefits of lending. It’s easier than ever before.

Using SoLo to lend is a great way to support a good cause and earn a return on your investment. Calculate the SoLo Score or check the transaction history of another member to determine their risk profile. You can use Solo’s tools to make informed loan decisions and manage your portfolio based on your risk and return goals. SoLo automates the rest of the process through automated workflow and a step-by-step update system.

In comparison to other small loans apps similar to SoLo Funds, including Dave and Earnin, SoLo Funds differs because it isn’t tied to employee paychecks and does not lend money. Rather, it crowdsources loan requests, allowing users to apply for loans on an open marketplace. As compensation for the risk, lenders have the option of earning tips of up to 12% of the original loan amount, which is set by the borrower in advance.

The loan amount can range from $50 to $500, but borrowers cannot request the amount they want. In order to increase the amount they can borrow, borrowers must establish a track record of timely repayment of loans.

12 Best Apps Like SoLo Funds for Android & iOS

To begin with, the question is: why use SoLo Funds when other apps are just as good or better than SoLo Funds? Check out other SoLo Funds alternatives, their featuyres, pros and cons in this article.

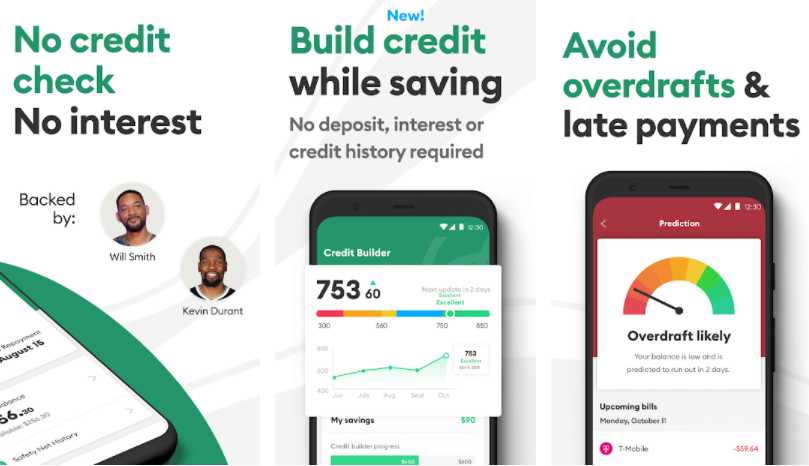

Brigit

With Brigit, you can save money and spend smartly. Instantly borrow up to $250 without any interest or credit checks. The app also helps you improve credit, stay out of overdraft charges, and increase your savings.

Unlike competitor apps like SoLo Funds that consider your income and employment to determine your eligibility and credit limit, Brigit considers the account you will be depositing the funds into.

The app checks whether you have enough money in your bank account before withdrawing the borrowed funds, and sets a new due date.

Brigit Features

- Tips for managing your money and financial education

- credit-builder loan – allow payments to be reported to the major credit bureaus.

- Monitor your credit and receive alerts

- Protection against identity theft

Brigit Pros

- An overdraft fee may be less expensive.

- Provides credit monitoring services and protection against identity theft.

Brigit Cons

- Bank account access is required.

- It may encourage people to borrow against their future earnings.

- Credit bureaus are not notified of repayments.

Prosper

Peer-to-peer lending app Prosper provides loans between individuals. Borrowers seeking personal loans are matched up with potential investors, and the qualification requirements aren’t as strict as some other apps like SoLo Funds. In the case of borrowers with fair credit, Prosper may be a viable option, but there are other lenders that may offer lower fees and lower interest rates.

Peer-to-peer lending app Prosper provides loans between individuals. Borrowers seeking personal loans are matched up with potential investors, and the qualification requirements aren’t as strict as some other apps like SoLo Funds. In the case of borrowers with fair credit, Prosper may be a viable option, but there are other lenders that may offer lower fees and lower interest rates.

Once you meet requirements, accept a loan offer, and have final approval, you can expect to receive funds within one business day in your bank account. Moreover, you can submit a personal loan application through Prosper with a co-borrower. A co-borrower with high credit scores may lower the interest rate of your personal loan.

Even though Prosper’s minimum credit score is lower than other SoLo Funds alternatives, there are still other criteria for eligibility.

Prosper Features

- Loan applications are processed quickly

- Check the interest rate instantly

- Credit loans for people with bad credit

- Penalty-free prepayments

- Profit potential at maximum

Prosper Pros

- No impact on credit rating when checking rates instantly

- Peer-to-peer funding removes the need for banks.

- Obtain a loan of up to $40,000

- Payment in an advance penalty is not applicable

- Funds can be received within three days

- The minimum investment is just $25

Prosper Cons

- An origination fee of 2.41% to 5% is charged

- Borrowers sometimes face high-interest rates

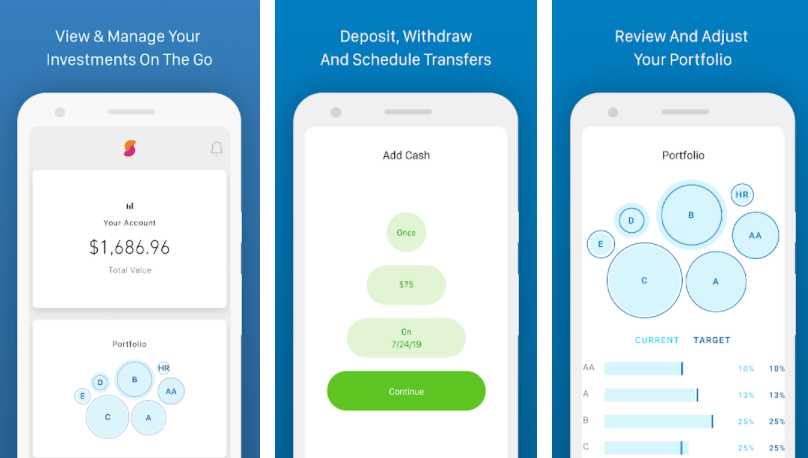

Lenme

An app called Lenme helps investors integrate their investment activities with their social life using social media. It’s rather simple compared with similar apps like SoLo Funds. As a result, while you can invest if you have money to spare, borrowers will not be able to build their credit scores or access other financial services offered by payday loan apps like Solo Funds, Dave, Earnin, and MoneyLion.

An app called Lenme helps investors integrate their investment activities with their social life using social media. It’s rather simple compared with similar apps like SoLo Funds. As a result, while you can invest if you have money to spare, borrowers will not be able to build their credit scores or access other financial services offered by payday loan apps like Solo Funds, Dave, Earnin, and MoneyLion.

The Lenme platform is an online marketplace that matches borrowers to investors. It allows you to lend and borrow digitally instantly. You don’t have to visit a bank. Through Lenme, you can borrow in minutes without paying hidden fees.

With Lenme, you can access credit scores, borrower’s history, financial information, and manage your lending process all through the app. If you borrow, you can borrow at a low cost of $1.99 a month to borrow a maximum of $5,000. You can get offers right away from over 7,000 lenders and lending businesses.

A lending platform, Lenme connects borrowers with financial institutions, lending businesses, and individual investors who are interested in investing in small amount loans.

No user’s identity is revealed during the entire process of borrowing/lending. To ensure fairness and competition in the market, the app provides a feed in which users can keep track of which loans have been funded and how much interest was charged.

Borrowers can apply for loans on Lenme with repayment terms of up to 12 months, which can be paid off in installments. Loans can be offered at a minimum of 3% APR according to the credit score and the criteria set by the lender. Multiple factors are considered in making lending decisions, accessible through the app, including credit, income, and cash flow for assessing a loan.

Lenme Features

- As few as 3 clicks can get you loan

- Set your own terms for repaying the loan

- Credit score will not be affected by a loan request

Lenme Pros

- The payback period can be extended

- Get a loan as little as $50

- You can choose investments that suit your risk tolerance easily

- Invest without paying a fee

- Set own terms of repayment

Lenme Cons

- An application for a loan is not guaranteed to be approved

- It is not possible to improve credit scores

- There is a lack of responsiveness in customer service

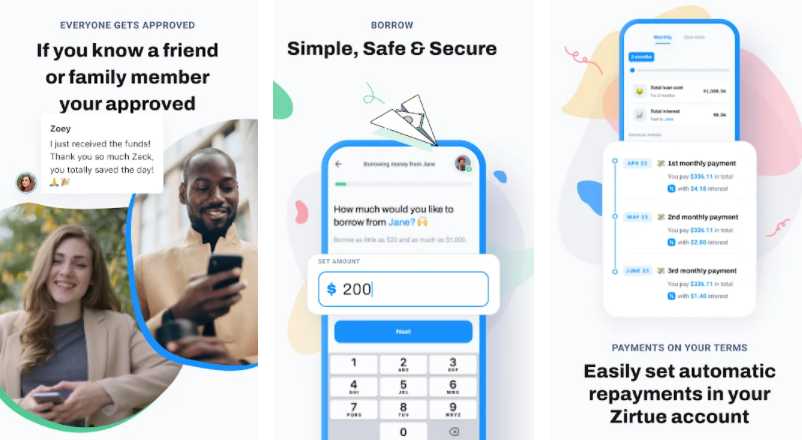

Zirtue

Relationship-based lending app Zirtue makes it easy to manage loans among friends, family members, and other trusted people.

Relationship-based lending app Zirtue makes it easy to manage loans among friends, family members, and other trusted people.

The Zirtue platform allows you to lend money to your friends and family in an easy and safe way. No matter what you’re paying for, Zirtue makes repayment easy, so you can pay attention to what really matters.

Zirtue is a safe and secure lending platform like SoLo Funds that lets you borrow and lend money based on your personal relationships.

Your personal dashboard allows you to monitor loan activity and send messages to lenders and borrowers. You can set up automatic deductions for easy repayment and to avoid thinking about it.

Zirtue has a range of loans and borrowing options starting at $20 and up to $1,000, with repayment periods ranging from 3 to 36 months. In addition, Zirtue offers one-time payments, which you can schedule for repayment at any time within the next three months to three years.

Zirtue does not charge any fees. However, an annual percentage rate (APR) of 5% will be paid to the lender during the period.

Zirtue Features

- Hassle-Free

- A user-friendly interface and easy to understand

- No paperwork

Zirtue Pros

- Your loved ones can lend you money in minutes

- Automates withdrawals from the borrower’s bank account

- Payback periods range from 3 to 36 months

- 0% APR

- There are no additional fees

Zirtue Cons

- Customer service

- It is necessary to know someone who is willing to lend you money

- The maximum loan amount is $1,000

- Android and iOS apps are not user-friendly

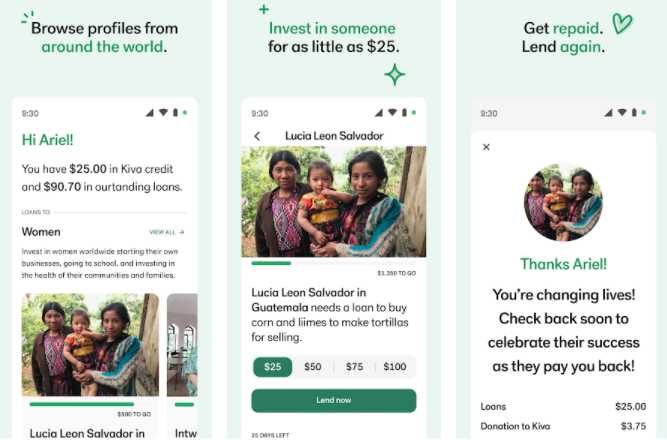

Kiva

Kiva deals with loan issues that have high rates of interest or strict requirements for borrowers through its unique model of crowdfunding. It provides interest-free business microloans, and the requirements for qualifying aren’t too strict.

Kiva deals with loan issues that have high rates of interest or strict requirements for borrowers through its unique model of crowdfunding. It provides interest-free business microloans, and the requirements for qualifying aren’t too strict.

Microloans are the only type of financing offered by Kiva. The company gives loans up to $15,000. No interest is charged on Kiva’s business loans. As you know, it’s hard to find no-interest loans. Credit scores are not considered by Kiva, nor is revenue amount. Borrowers must meet a few simple requirements.

Of course, Kiva will consider your business’s length of existence, revenue, and other aspects when determining the amount of your loan. In addition to all that, Kiva claims that over 90% of potential borrowers receive funding. Which is quite impressive.

With smaller loans, the repayment period will be less. A loan of over $6,500 qualifies for a full three-year term. The concept of microlending is based on the concept that borrowers with financial needs receive support from multiple lenders.

Kiva Features

- The company does not charge any fees

- Zero-interest

- Sufficient repayment periods

- High success rates of loans

- No credit check

Kiva Pros

- Loans with no interest

- Qualifications of borrowers are few

- The success rate of funding is high

- 36-month repayment period

Kiva Cons

- Loan size limited to a small amount

- The funding process takes too long

- Kiva does not report credit information to credit bureaus

Possible Finance

Through its mobile app, Possible Finance provides small loans with high-interest rates. People with no credit history or poor credit may be eligible for $500 loans, though they are only available in certain states.

Through its mobile app, Possible Finance provides small loans with high-interest rates. People with no credit history or poor credit may be eligible for $500 loans, though they are only available in certain states.

The company is positioned as SoLo Funds alternative for payday loans, high-interest, short-term loans repaid directly from your paycheck. Possible Finance offers lower interest rates and lets you pay back your loan in 8 to 12 weeks by making monthly or bi-weekly payments.

In addition to this, Possible reports all loan payments to the major credit reporting agencies — Equifax, Experian, and TransUnion. So you can build credit by making timely payments.

Possible Finance Features

- No credit check

- No prepayment fees

- Reports payments to three credit bureaus

- Measures ability to repay before lending

- By debit, you can receive your funds instantly

Possible Finance Pros

- Loans for users with no credit history or bad credit

- There is an option to delay your payment

Possible Finance Cons

- Offers loans only up to $500

- High-interest rate

- Customer service is limited

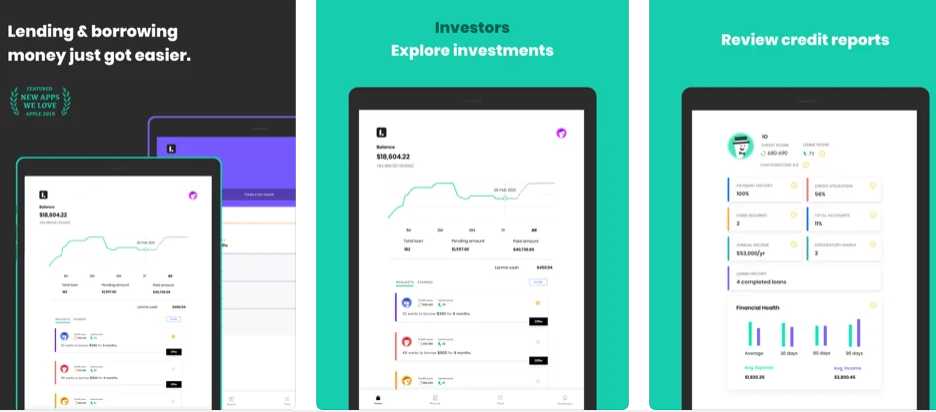

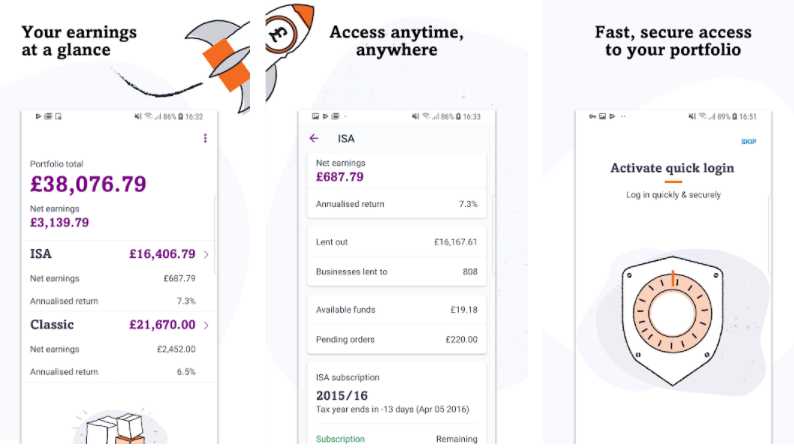

LendingClub

LendingClub provides completely branchless banking and loans ranging from $1,000 to $40,000. The company connects investors, or peer-to-peer lenders, and matches them with consumers. Borrowers have the option of 36 or 60-month loan terms. In comparison with other apps like SoLo Funds, this app has more flexible eligibility requirements, allowing borrowers with fair credit to consider it.

LendingClub provides completely branchless banking and loans ranging from $1,000 to $40,000. The company connects investors, or peer-to-peer lenders, and matches them with consumers. Borrowers have the option of 36 or 60-month loan terms. In comparison with other apps like SoLo Funds, this app has more flexible eligibility requirements, allowing borrowers with fair credit to consider it.

There are currently 50 states in which LendingClub offers personal loans. LendingClub personal loans have an average term of 36 months. The company’s loan terms are more flexible than its rivals and SoLo Funds competitors, which offer a variety of loan terms, sometimes even as long as seven years.

If a borrower makes a late payment, a fee of 5% is charged, up to a maximum of $15. Despite this, LendingClub does offer borrowers a 15-day grace period. There are no prepayment penalties at LendingClub if you pay off a loan before it is due. In other words, if you pay off your loan early, you will not incur any extra fees.

LendingClub Features

- Payment date flexibility

- Extra services like auto refinancing and patient financing

LendingClub Pros

- Provides direct payment of third-party creditors

- Applicants can submit joint applications

- Credit scores between fair and excellent are also eligible

- No early payment penalty

LendingClub Cons

- Late fees and origination charges

- Loan terms are limited

- There is no discount for automatic payments on high annual percentage rates (APRs).

MoneyLion

MoneyLion provides its members with credit-building loans without checking their credit. Credit-builder loans are available at low-interest rates at MoneyLion, but there is an additional membership fee. You can borrow up to $1,000 with MoneyLion with terms starting from one year.

MoneyLion provides its members with credit-building loans without checking their credit. Credit-builder loans are available at low-interest rates at MoneyLion, but there is an additional membership fee. You can borrow up to $1,000 with MoneyLion with terms starting from one year.

A credit-builder loan from MoneyLion can have an interest rate ranging from 5.99% to 29.99%. A Credit Builder Plus membership doesn’t require excellent credit scores to be eligible for the credit-building loan. MoneyLion has absolutely no interest in checking your credit. Rather than analyzing your credit score, MoneyLion looks at your primary checking account, if it meets certain requirements to determine your eligibility.

MoneyLion Features

- Financial app with all the features you need

- Provides credit-builder loans at low-interest rates

- APR of 0% on cash advances

- 55,000+ ATMs without any fees

- Free credit monitoring

- Additional services

MoneyLion Pros

- Sends reports to three major credit bureaus so it can boost credit

- There is no hard credit check

- No prepayment penalty

- A variety of useful services, including credit building loans and 0% APR cash advances

MoneyLion Cons

- A membership fee per month

- Provides small loans only

- Funds from a loan may be placed in a reserve account until it is paid back

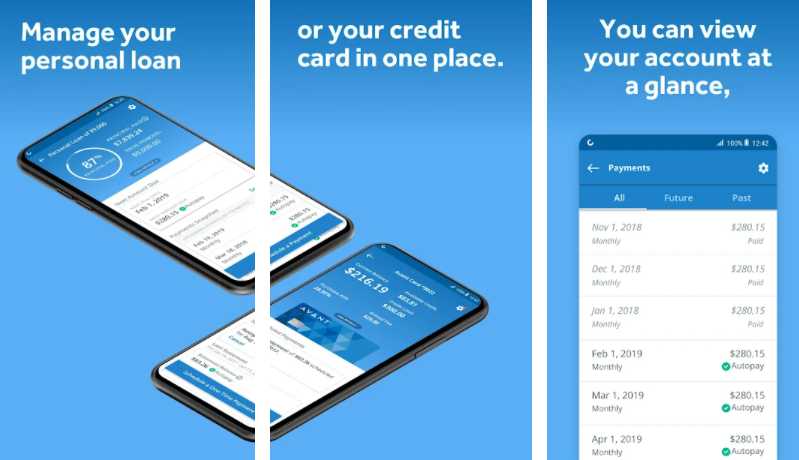

Avant Credit

Avant Credit is a great choice for personal loans, especially if your credit score is low or you need money immediately. A low credit score may result in a high APR. Funds can usually be provided the next business day if you qualify.

Avant Credit is a great choice for personal loans, especially if your credit score is low or you need money immediately. A low credit score may result in a high APR. Funds can usually be provided the next business day if you qualify.

There is a 24-month minimum loan term and a 60-month maximum loan term. If you pay off your Avant loans early, there is no penalty for doing so.

The loan amount ranges from $2,000 to $35,000. Online lenders have a good range of options, especially those offering loans to consumers with good credit scores.

Using Avant’s mobile app, you can view your payment history, calculate your repayment amount, set up recurring payments, and receive notifications.

Avant Features

- A variety of loan amounts

- up to $35,000 is possible

- Quick funding

- Easy loan management with the help of a mobile app

- The rates offered by online lenders are competitive.

- A minimum revenue requirement does not apply.

Avant Pros

- Loans can be funded the next business day.

- Your payment date can be changed.

- Soft credit check

Avant Cons

- The amount of the loan is comparatively low

- High-interest rates

- The administration fee is up to 4.75%

- A late fee of $25

Funding Circle

The Funding Circle is an online lending platform for businesses that offer secured loans and a variety of business financing options, such as merchant cash advances and invoice factoring. Amounts of funding vary depending on the product, typically ranging from $5,000 to $500,000, with interest rates ranging from 3.9% to 12.1% annually.

The Funding Circle is an online lending platform for businesses that offer secured loans and a variety of business financing options, such as merchant cash advances and invoice factoring. Amounts of funding vary depending on the product, typically ranging from $5,000 to $500,000, with interest rates ranging from 3.9% to 12.1% annually.

The rates offered by Funding Circle are competitive and extend up to $500,000. You won’t need a minimum yearly revenue to qualify, but your business must be at least two years old and have at least 660 in credit scores. Getting a loan through Funding Circle is much faster than applying for a loan through other apps like SoLo Funds.

Funding Circle Features

- It does not require a minimum revenue level.

- Provides high amount loans from $5,000 to $500,000

- Also offers invoice factoring

Funding Circle Pros

- There is no prepayment penalty

- Large loan amounts

- Three-month to ten-year repayment terms

Funding Circle Cons

- Getting a loan may be difficult

- Origination and late fees

- Various types of funding are available depending on the state and industry

- The funding process can take a while compared to other apps like SoLo Funds.

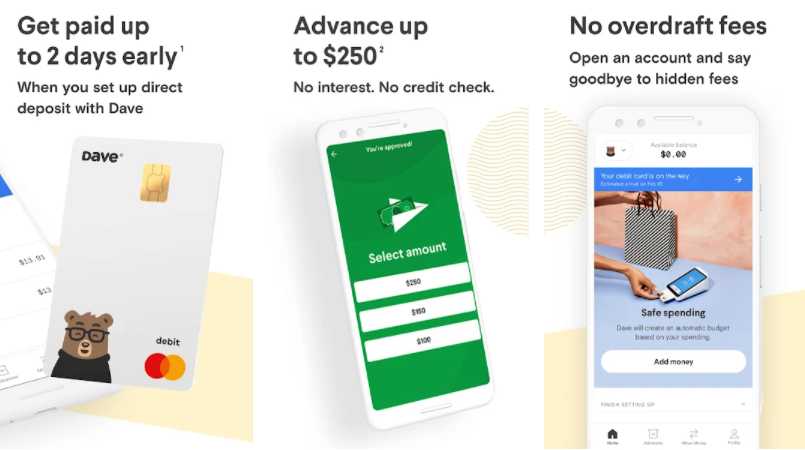

Dave

By using Dave, users can receive a paycheck advance for small expenses such as groceries or gas. Furthermore, the company offers a “spending account” that charges no fees for overdrafts.

By using Dave, users can receive a paycheck advance for small expenses such as groceries or gas. Furthermore, the company offers a “spending account” that charges no fees for overdrafts.

The monthly subscription fee is what Dave charges rather than interest. Users may optionally tip Dave for services. There may be cheaper alternatives to Dave for those who need cash for an emergency.

Dave doesn’t analyze your credit report or provide payment information to credit bureaus, so using the app will not affect your credit score.

Your loan amount will be automatically withdrawn from your linked bank account if you do not repay it before the due date.

Dave Features

- No-interest

- No credit checks

- Possibility of saving money

- Options for financing

- A tool for budgeting

Dave Pros

- A cheaper alternative to an overdraft fee.

- Borrowing money at a low or no fee can be a good option

- No additional fee for cash advances except membership fees.

Dave Cons

- Paid membership

- Repayments are automatically deducted from your bank account

- Cash advances are limited to a low amount

- Payday advances are limited to $100.

Earnin

Like a payday loan, Earnin lets you borrow money immediately from your next paycheck. You will automatically be charged for the amount you borrowed from your checking account on your next payday.

Like a payday loan, Earnin lets you borrow money immediately from your next paycheck. You will automatically be charged for the amount you borrowed from your checking account on your next payday.

It may be a good idea to use Earnin if you sometimes need a small lump sum ahead of your next paycheck and also agree to meet their eligibility requirements.

Balance Shield Alert is a feature in the app that notifies you when your balance drops below a certain amount.

A loan is given based on the amount of work you’ve already done, and the amount used will be deducted from your check once it’s received. Like borrowing money from a friend, the app works by you pledging to pay it back the next time you get paid.

Earnin Features

- You can prevent bank overdrafts by using the Balance Shield feature

- The app is available both for Android and iOS devices

Earnin Pros

- There are no fees or interest, and tips are up to the customer

- No credit check required

- The money is available to you the same day you request it.

Earnin Cons

- A person’s loan eligibility is determined by how much they earn and what kind of job they have

- The withdrawal limit is too low.

Final Words

This ends our list of best working apps similar to SoLo Funds. Remember, taking out loans against your future earnings isn’t a wise financial decision. Over time, loans can become expensive because of interest.

Most of the time it is unclear what the terms and conditions are, and repayment can be difficult due to interest or other charges.

People in need of money might find it interesting to avail of hassle-free apps like SoLo Funds. Many fake or scam apps available on the internet require no documentation, signatures, or paperwork and claim to provide loans in a short time frame.

But before trying such apps you have to be careful as it can be life-threatening too. I hope you like this article. If you find any other SoLo Funds alternative, mention the name in the comments section below.