This article will introduce you to some of the best cash advance apps like Empower. The majority of them offer affordable credit like Empower without credit checks. Also, some also provide payday loans with no mandatory repayment time frames, which is an amazing thing.

Empower is a well-known app that provides instant cash advances up to $250, but it is not alone. On the Android & iOS app stores, a number of other apps that gives you cash advance are available, usually with some differences in features and conditions.

If you don’t have enough money to cover all your expenses, and it is still a long way until payday, Empower will help you out. Empower provides you with emergency cash without burdening you with debt by offering interest-free cash advances. Even though Empower is a popular and useful app, it may not suit your needs.

All of the apps mentioned can be downloaded from the iOS App Store or Google Play Store. Check out different options and take the time to compare their features and terms and conditions before using these cash advance apps.

Take a look at cash advance apps like Empower that you can use when you need money in an emergency situation. These are the apps that give you money before payday.

Best Apps Like Empower: Alternative Apps That Give You Advances

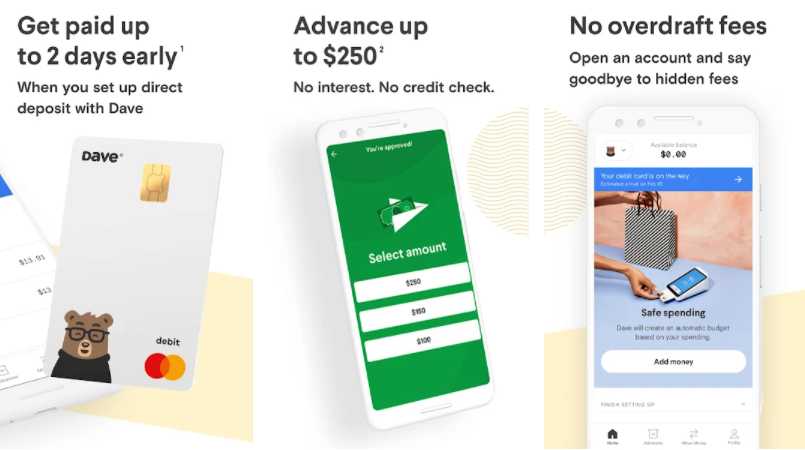

Dave

Dave allows users to get advance money from their paycheck to help pay for small expenses such as electricity, broadband, fuel, or groceries. Those looking for more apps like Empower should consider Dave as the best alternative.

Dave allows users to get advance money from their paycheck to help pay for small expenses such as electricity, broadband, fuel, or groceries. Those looking for more apps like Empower should consider Dave as the best alternative.

Rather than charging interest, Dave charges a subscription fee every month. There is also the option of giving tips. Using your next paycheck, you can pay the amount due on the app and pay your monthly bills as well.

Paying back an advance can be done manually or automatically through a bank account. You don’t need to good credit history to qualify for a cash advance from Dave. Rather, it uses machine learning to analyze your earnings, your spending habitts, and the amount in your bank account on a regular basis.

Dave uses its budget feature to keep track of your income and expenses so you can budget for future expenses and notify you if you are at risk of overdrawing your account.

The side Hustle option on the app lets Dave customers earn extra income by doing flexible work. You can work as a rideshare driver or rider and a food delivery service with this feature.

Through a partnership with LevelCredit, Dave allows users with spending accounts to report their rent and utility payments to the main credit reporting agencies. By choosing this option, you can build credit by paying on time, but missing payments can harm your credit score.

Dave may be worth considering if you are a salaried individual in need of a little extra cash, such as to pay off a small amount of debt or to cover an unexpected expense. You can get $100 from Dave and $200 if you are a Dave Banking member. Upon approval for a cash advance, you will have the option of choosing standard deposit or express deposit options.

There are no credit checks or interest charges. Dave Banking members are entitled to this $100 service free of charge. The service also provides a Debit Card.

No hidden fees are associated with Dave Banking. Also, there are no minimum balance requirements or overdraft charges. As a bonus, Dave users can use over 30,000 ATMs with Money Pass without any charges.

Features

- There is no interest and no credit checks

- You’ll receive an alert if your bank account appears at risk of being overdrafted

- Offers tools for budgeting

- Finds side jobs for you

- You can receive your pay two days early

- Helps you to improve your credit score.

Eligibility Criteria

- An email address that is valid.

- You should always have money in your account.

- A regular income source is required.

- 3 recent deposit paychecks proofs.

- A debit card.

How to get cash advance from Dave app

- Install the Dave app on your phone.

- Open the Dave lender app and create your Dave account by entering your mobile number.

- In order to verify your number, you will receive a 4-digit code. Once you enter the code, you will then be able to link your debit card to the bank account.

- In order to verify your Debit Card, Dave withdraws $0.01 from your account.

- Upon creating an account and confirming your identity, the app automatically tracks your transactions.

- Once you have completed the verification process, you can borrow up to $100 at any time using standard funding or quick funding and you also receive alerts when you go overdrawn.

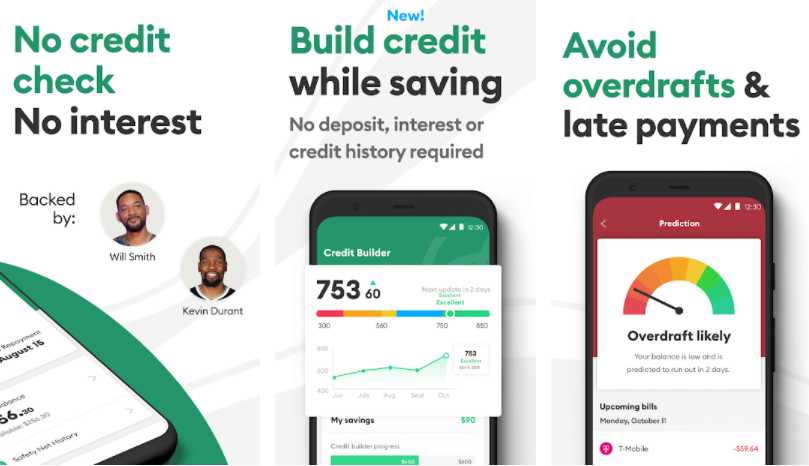

Brigit

Brigit offers up to $250 in paycheck advances at no interest. If you are someone who occasionally needs a small loan then Brigit can be a great Empower alternative for you, though you will have to pay for the convenience.

Brigit offers up to $250 in paycheck advances at no interest. If you are someone who occasionally needs a small loan then Brigit can be a great Empower alternative for you, though you will have to pay for the convenience.

Additionally, it has a budgeting tool. Moreover, Brigit monitors your spending patterns and, if you purchase a Plus subscription, it automatically advances you money when it believes you are about to exhaust your account.

You’ll need to pay a monthly fee of $9.99 for many of its features, and not all users qualify. You will get enough benefits from the credit building and budgeting tools to make monthly fees worthwhile.

It also comes with a free version that provides money-saving tips and budgeting tools. Brigit offers a viable alternative to expensive payday loans. Although Brigit does not charge you interest, you will have to pay a $9.99 monthly fee, which means you can’t get a cash advance for free.

If you are someone who often has unexpected expenses or someone with a plan to pay back the loan and take care of your other expenses or an individual who regularly receives deposit payments then Brigit is a great app for you.

You may also be able to extend the due date if you are unable to make the payment or change the date with no late fees.

Features

- No credit check – Brigit does not conduct credit checks when you apply for the service

- You won’t pay any transfer charges, interest, processing fees, late fees, or tips

- Payback your advance early – You won’t be penalized for early repayment.

- Credit-builder loan – Consumers may opt to take out a credit-builder loan in order to have their bills reported to the three major credit agencies.

- Keeping an eye on your credit and being notified – You can view your credit score and credit report, perform a credit score simulation, and be alerted to changes that might impact your credit.

- Protection against identity theft – Their identity theft system provides cash compensation in the event of identity theft. The company also cancels and replaces lost credit cards and ID cards.

- It is available for both iOS and Android devices.

Eligibility Criteria

- You must have an account that is at least 60 days old.

- Use it every day for a couple of weeks

- A balance greater than zero

- After you receive a paycheck, make sure you have enough to repay advances

- A minimum of three automatic payments each month, which total at least $800.

- Users get a score from 0 to 100 based on several factors, including the balance of your account, your deposit amount, and your spending to earning ratio.

How to get cash advance from the Brigit app?

- Once you’ve downloaded the Brigit app, open it

- Create an account and link your bank account. With this account, Brigit will withdraw the subscription fee each month and deposit cash advances.

- The Brigit team evaluates your account, calculates your score, and determines your eligibility.

- Payment of the subscription fee is required if you qualify.

- Make an advance request. Brigit transfers the funds to your account immediately and sets up a repayment schedule.

- A notification is sent to you two days before and on the due date. Selecting the “Repay now” button will allow you to repay the money early.

- Your account is debited of the advance amount by Brigit.

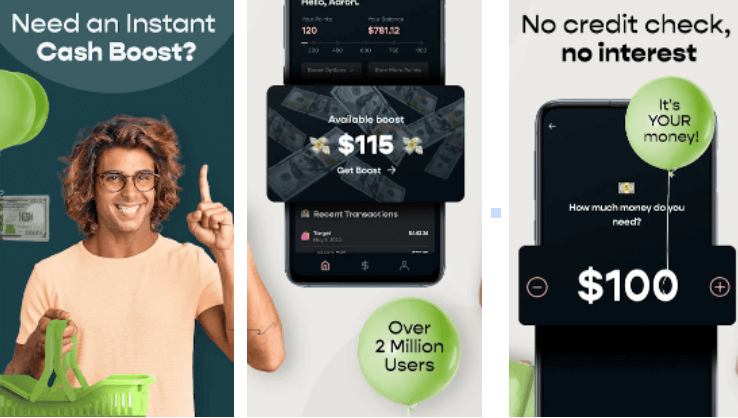

Klover

Klover app makes the list of payday apps like Empower as it provides cash advances for short-term cash needs without credit checks. Using your data, the app connects you to a number of financial services. Using Klover is as simple as downloading it from the Android and iOS app store, verifying your pay stub, and connecting your bank account.

Klover app makes the list of payday apps like Empower as it provides cash advances for short-term cash needs without credit checks. Using your data, the app connects you to a number of financial services. Using Klover is as simple as downloading it from the Android and iOS app store, verifying your pay stub, and connecting your bank account.

You can receive cash advances from Klover in the standard direct deposit way, however, if you want to avoid charges, it may take up to three business days for the funds to reach your account. To get money faster, you can pick an express funding option instead of standard funding. But you need to pay an express fee based on how much you want.

No interest will be charged if you get a cash advance through the Klover app. Moreover, rewards points can be redeemed to receive extra cash or for a chance to win a prize. In order to earn points, simply scan receipts, answer survey questions, or watch video ads.

As long as you have regular wages and occasionally need cash advances for expenses, you may find the Klover app useful. Since there is no interest on the cash you borrow and you can get money in a hurry, this might be a great alternative to Empower.

Klover’s withdrawal limit is between $100 and $130 with boosts. It typically takes two to three business days to credit advance to your account. There are a number of user-friendly features in the Klover free app.

There are no credit checks, interest rates, or fees associated with advances. In contrast to other apps like Empower, which only consider your earned wages when calculating your advance, Klover offers additional ways for you to increase your advance on the app.

Klover+ provides premium services for a low monthly fee of $2.49. Customers can monitor their credit with Experian and keep track of their spending with the Klover+ subscription. In addition, you’ll be able to compare products, get financial advice, and earn triple points for scanning receipts.

In our review, we found Klover to be a strong competitor to other pay advance apps like Empower.

Features

- No credit check and no interest charges

- Amounts of the advance can be increased by doing simple things like watching an ad or scanning receipts.

- Transparency in privacy policies

- Automated tools for budgeting and saving

- Monthly fees are as low as $2.49 for Klover+

Eligibility Criteria

- Email address and phone number

- You will need a bank account that is at least two months old

- Direct deposits should be made to that bank account, and your paycheck must be at least $250.

- To qualify, you must have earned three paychecks from the same company, without a pay gap in between.

- You must have a positive balance in your bank account

How to get cash advance from Klover app?

- Download the Android/iOS app

- Now sign-up for the Klover. It doesn’t require lengthy paperwork, credit checks, additional charges, or hidden costs.

- Signing up for an account does not require your employer’s approval.

- When signing up for Klover, you must show proof of your paychecks and three paychecks that have been deposited directly into your bank account in the same employer’s name in the previous two months.

- Once you qualify for Klover advances, you are allowed to borrow up to $100 cash advances are available any time.

- Upon request, the funds are deposited immediately or within one to two business days.

MoneyLion

MoneyLion has made it to the list of best apps like Empower as it provides credit-building loans up to $1,000 through its Credit Builder Plus membership. You can also get 0% APR Instacash advances up to $250, mobile banking services, investment management, and other perks.

MoneyLion has made it to the list of best apps like Empower as it provides credit-building loans up to $1,000 through its Credit Builder Plus membership. You can also get 0% APR Instacash advances up to $250, mobile banking services, investment management, and other perks.

MoneyLion offers a comprehensive range of digital financial services. Unlike other apps similar to Empower by working in a similar manner, MoneyLion provides a range of accessible and useful services designed to help anyone improve their financial situation.

MoneyLion helps you overcome financial obstacles by supporting you to build your credit or get started investing through the app. You can apply for a no-interest cash advance of up to $250 through your MoneyLion app.

As part of your credit monitoring service, you’ll receive regular updates specifically related to your credit report, including payment history, transaction history, and credit usage. MoneyLion app also allows you to invest for free and without a balance.

Besides being user-friendly, their interest rates are reasonable, and they offer excellent, responsive customer service.

The credit builder loan from MoneyLion has the advantage that you will receive part of the loan amount upfront. The funds will be received immediately or within 48 hours (based on the funding method you select). The remainder of your loan amount will be deposited into your Credit Reserve Account, and you will receive it once you have repaid your entire loan.

All types of credit scores are eligible for all sizes of loans. The Money Lion app allows customers to apply by linking a checking account and receive an approval within minutes. The app does not impose penalties for early repayment. There are no additional fees involved if you pay off your loan early.

Through the ‘Monthly Repayment Calculator’, it is possible to estimate your loan cost and repayment amount. Furthermore, you can reschedule or change the date of the payment.

Credit Builder Plus loans offered on the MoneyLion app have annual percentage rates between 5.99% and 29.99%.

Features

- A fast funding process

- No hard credit check

- Easy repayment

- Early repayment option with zero penalty or fees

- Fair and transparent fees

- Offers premium services

- Cashback of up to 5% on everyday purchases.

Eligibility Criteria

- The age requirement is 18 years or older

- United States citizen or permanent resident

- You need a Social Security number

- You must have a bank account, debit card, or prepaid card.

How to get cash advance from MoneyLion app?

- To open a MoneyLion account, sign up on the website or the MoneyLion app.

- If you’d like to apply for the loan, you’ll need an address, social security number, phone number, full name, and bank account.

- Upon approval, you’ll receive a portion of your loan in your bank account.

- By joining MoneyLion Core, you gain access to the MoneyLion RoarMoney Fee-Free Checking account and the MoneyLion Managed Investment account.

- As soon as you have a Credit Builder Plus account, you will be able to borrow up to $1,000. When you repay the loan, the savings will be available in your Credit Builder Plus account.

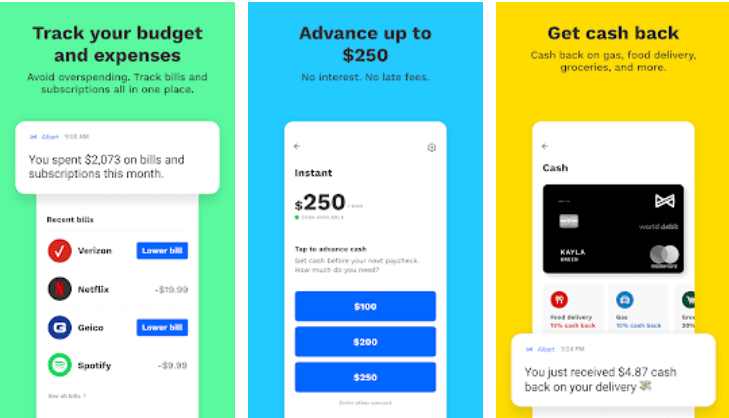

Albert

Albert offers a variety of financial tools for saving money, combines all of your accounts to give you a 360-degree view of your finances, reduces your bills, provides financial assistance, creates a personalized budget, and can even help you invest your money. Essentially, all-in-one financial app.

Albert offers a variety of financial tools for saving money, combines all of your accounts to give you a 360-degree view of your finances, reduces your bills, provides financial assistance, creates a personalized budget, and can even help you invest your money. Essentially, all-in-one financial app.

Albert shares many similarities with apps like Empower, Qapital, or Digit. You might be in need of a bit more assistance in getting your finances under control, Albert might be the app you’re looking for.

Albert is another trusted app that gives you money until payday. If you work for an employer who pays you a paycheck and you have an Albert Cash account, Albert advances you up to $100 fee-free before your paycheck arrives. If you have a good salary and meet other requirements, you may be eligible for a cash advance of above $100. In any case, if you are not planning on banking with Albert, you can still get cash advances up to $250 with Albert Instant.

The typical turnaround time for the advance will be up to three business days and you will not be charged a delivery or repayment fee. However, if you want an urgent advance for some of your expenses then you can select the immediate option that gives you cash advances within 10 minutes. However, you’ll be charged $4.99 as a delivery fee to be deducted next pay period in addition to the amount borrowed.

Albert’s no-fee advance credit can be helpful in situations like forgetting to pay a large bill so that you won’t run low on cash. Additionally, Albert has partnered with BillShark so that users can get a better deal on bills including cable, internet, and insurance. BillShark is one of the popular apps similar to Truebill.

Features

- Offers on-top financial tools

- No credit check, no interest requirement, and no late fees

- It is not mandatory to repay within a minimum or maximum amount of time

- You can save money by tracking your spending and income

- Protects your sensitive personal information with advanced security technology

Eligibility Criteria

- You should have received consistent income over the past two months

- Your income/salary must have paid on a regular basis.

- You must have a positive balance in your bank account.

- Be a citizen or resident of the United States.

- Minimum age of 18 years is required.

- Have a U.S. bank account.

- You must have a mobile number from a U.S.-based carrier.

- You must have the Albert app on your Android or iOS device.

How to get cash advance from Albert app?

- Download and install the Albert app

- After that simply go to click the “Instant” option on the Albert app

- Follow the instructions to create an account.

- Upon approval, you will be able to choose your amount and delivery option.

- As soon as you make a request, the money will be deposited directly into your bank account.

Possible

Possible Finance is one of the popular apps that give you advances. This app provides users with short-term installment loans. Those without credit history or with bad credit are eligible to receive cash advances of up to $500 loans.

Possible Finance is one of the popular apps that give you advances. This app provides users with short-term installment loans. Those without credit history or with bad credit are eligible to receive cash advances of up to $500 loans.

Possibile’s interest rates are lower than payday loans, and repayment can be completed in 8 to 12 weeks through two-week or monthly installments. A borrower can choose the date of loan repayment at the time of loan approval.

Possible reports of loan payments to three of the largest credit reporting agencies such as Equifax, Experian, and TransUnion. Thus, if you make timely payments that will help you increase your credit score.

The app doesn’t pull your credit score so even people with bad credit might be eligible. Also, remember that Possible Finance only offers small installment loans that you must repay within two months.

If you are approved for a loan and you pay it back on time your whole loan, you have the ability to build credit history slowly.

Features

- You can build your credit by using this service

- Only small loan amounts are available

- Option to delay your payment

- You will receive a payment reminder notification

- Borrowers have the option of choosing when to repay their personal loans while applying.

Eligibility Criteria

- You must submit a valid driver’s license

- To verify your identity, you will need your Social Security number.

- You must have a online checking account that has been active for three months

- A minimum deposit of $750 per month and at least a couple of positive balances are required.

- Make sure you have money left over after paying your bills

- Possible Finance mobile app

How to get cash advance from Possible app?

- After downloading the Possible app, open it

- Applying for a Possible Finance advance credit by submitting some personal details is through the app.

- In case of approval, the app allows you to receive a personal loan or advance up to $500

- Once you request the advance, the app displays the date when you will receive funding. A loan application is submitted before 2 p.m. on a weekday, your deposit will be made the following business day. In the requested cash advance after 2 p.m., it will take two business days for the funds to arrive.

- A debit card can also be used to receive the money so that it can be accessed more easily.

- You will receive a notification about payment due dates from the app.

ALSO READ: – How to Delete Possible Finance Account? (Guide)

Earnin

You might have already heard the name of this app. Earnin is one of the trending apps that give you money before payday. Earnin allows you to withdraw small amounts of your salary in advance. There are no fees or interest charges with Earnin cash advances. For the service, Earnin gives users the option of tipping.

You might have already heard the name of this app. Earnin is one of the trending apps that give you money before payday. Earnin allows you to withdraw small amounts of your salary in advance. There are no fees or interest charges with Earnin cash advances. For the service, Earnin gives users the option of tipping.

Earnin can come in handy in an emergency. Users can get emergency funds up to $500 in a pay period. You can receive an overdraft notification through the Balance Shield Alert feature once your account reaches a certain threshold.

By enabling the Balance Shield Cash Out option, Earnin will also deposit up to $100 directly into your bank account as soon as your balance falls below $100. The amount deposited will be added to your daily and pay period borrowing limits.

Initially, you can only borrow up to $100 every payday. However, as you use Earnin more frequently, you may be able to withdraw up to $500 depending on your usage, your spending habits, the bank you use, etc.

Features

- There are no fees or interest, and tipping is optional

- Lightning Speed option to transfer the money to your bank account the same day you request it.

- Balance Shield protects your bank account from overdrafts

- Both Apple and Android users can use this app.

Eligibility Criteria

- Email address

- Personal information about paychecks

- Bank account details

- Information about the employer

- At least two direct deposits (total of $100) must be made into your checking account

How to get cash advance from Earnin app?

- Download and install Earnin app on your Android/iOS device

- Open the app after installation

- Once you signup. Earnin can take up to 72 hours to activate your account to provide you with cash advances

- Upon approval, you can borrow $100 directly to your bank account.

- After you select an amount, Earnin asks whether you want to add a tip between $0 and $14 for the service, and Earnin deducts those amounts from the amount you borrowed.

- The money will be transferred within one to two business days on weekdays, and within two business days on weekends.

- You can receive the money immediately through the Lightning Speed option only if your bank offers it.

Other Empower Alternatives

RECOMMENDED: 12 Apps Like SoLo Funds to Lend & Borrow Money (2022)

Which Empower alternative should you choose?

Despite our best efforts, we can’t name one Empower alternative that fits everyone’s preferences. It all depends on eligibility, interest rate, late fees, other charges as well as repayment period.

It’s also a good idea to check if the specific app you’re going to use meets every requirement and also don’t forget to check their interest charges or late fees. We hope this post was helpful for you in finding the best apps like Empower.

This concludes this article. If you know any other app that gives you cash advance similar to Empower then mention the name in the comments section below.