Here are 7 popular rent paying apps like Flex – Rent you can use to pay your rent in installments easily available on both iOS and Android.

Renters know that the rent you pay at the end of the month will be your largest expense. Flex – Rent makes it more convenient to pay for your rent. Flex divides your rent into two so that you pay it in smaller monthly payments.

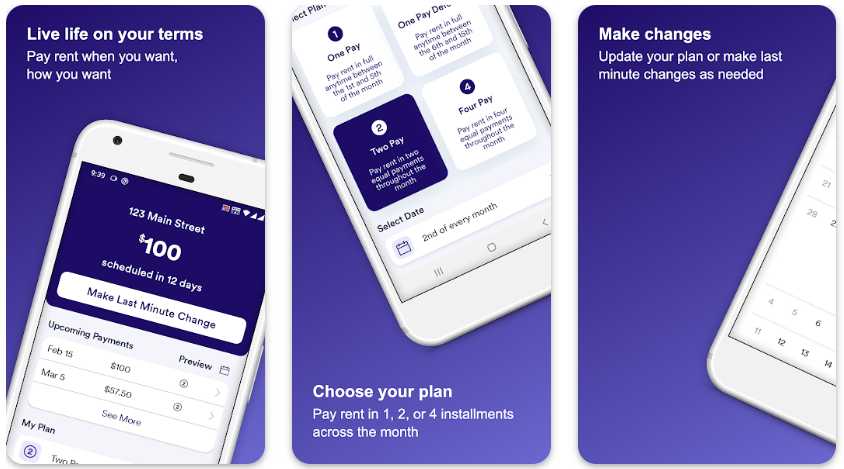

Flex aims to change how you pay your bills as it aligns your most important payments into your budget, allowing you to spend money confidently, develop better spending habits, and most importantly, be in control of your spending.

This app enables you to pay your rent on time, allows you to pay in two installments, and gives you the flexibility to pay on your own schedule.

By making your payments to Flex on time, you will have your monthly rent payment automatically covered. You will be notified if a payment is missed, and your plan will be put on hold, but you won’t be charged a late fee.

In order to access Flex’s services, you must pay $19.99 per month as a monthly membership. Flex doesn’t charge fees.

It is ideal for renters living paycheck to paycheck, provided they don’t have to pay too much for the service.

Flex rent app provides a useful service to millions of users struggling to pay rent on time. However, the payments are still needed within the month, Flex – Rent will not solve long-term financial problems, however, it can help those experiencing difficulties in their personal lives or schedules.

However, depending on your financial situation, Flex can help you manage your rental more effectively.

There are some limitations to the platform, so it may not be suitable for all renters. So, if you are looking for alternative apps like Flex – Rent, then this article is for you.

7 Best Apps Like Flex – Rent (Alternatives)

Learn more about the best apps like Flex for rent below. Here is a brief overview of each of the apps.

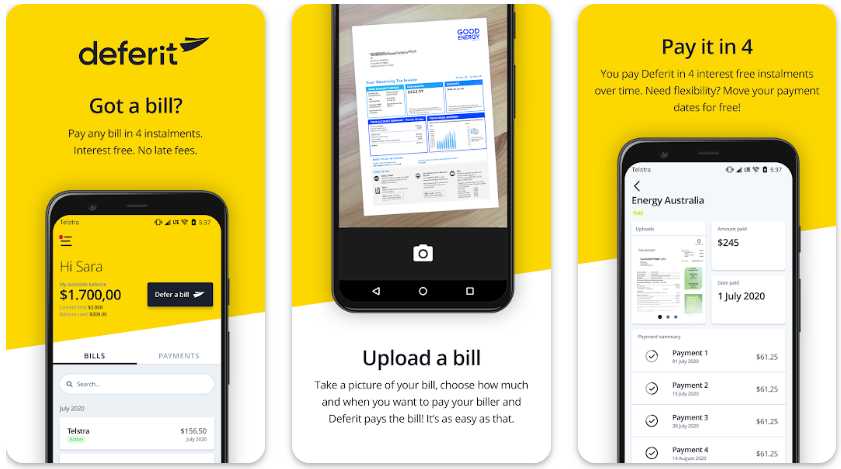

Deferit

There have been many users who have benefited from the app when it comes to paying their bills completely and on time without going bankrupt before payday. It is very easy to sign up, and payments are made without any issues.

You won’t find a better app than Deferit for paying your utility bills and car registration. Rather than incurring interest, there is a small monthly fee as long as you are actively paying bills.

Depending on your needs, you can select the amount, and date of payment, and extend payments as needed.

There is no doubt that Deferit: Pay bills in 4 app is recommended for anyone who wants to manage a budget more easily by making frequent, smaller payments rather than larger ones every month.

Due to the increasing costs of all things, Deferit allows you to avoid being left out in times of financial difficulty.

It is an excellent choice if you need help paying off bills in four easy fortnightly payments!! A monthly fee of just $5.99 is all you need to pay.

The app has such an easy interface, responds quickly to the uploaded bills, and allows for multiple bills to be managed simultaneously.

Users will find the website and app easy to navigate and simple to use. You can view all the bill-related information, including payment dates, current, pending, and past bills. Moreover, the payment dates can be changed according to your preferences.

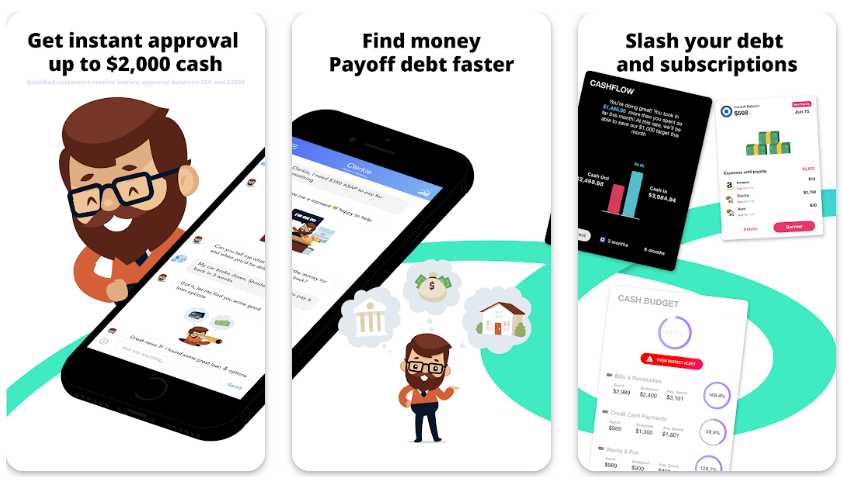

Clerkie

Clerkie helps you manage your finances, make budgets, and get rid of debt faster. Using their debt payoff planner, you can increase your credit score and pay off your debt. If you’re looking to consolidate your credit card debt or take out a loan in an immediate need, you can access personalized offers through the app.

Clerkie helps you manage your finances, make budgets, and get rid of debt faster. Using their debt payoff planner, you can increase your credit score and pay off your debt. If you’re looking to consolidate your credit card debt or take out a loan in an immediate need, you can access personalized offers through the app.

Reduce your debt by up to 70% with the debt manager. Using this feature, users have saved thousands of dollars.

Set up an automated budget so you can spend less and pay off debt and bills. No matter if you’re looking to refinance your credit card debt or need a loan right away, Clerkie helps you find the best offer based on your credit rating.

Clerkie employs SSL 256-bit encryption similar to that used by banks to safeguard sensitive information and keep it safe.

There is also a debt payoff planner and calculator that shows you the amount of extra money you can afford to pay in order to pay off your debt more quickly. It makes it easier to pay off your debt faster if you pay a regular monthly amount.

ALSO READ: –

- 12 Apps Like SoLo Funds to Lend & Borrow Money

- 16 Best Sites Like Afterpay (Alternatives with No Credit Check)

- Quadpay Alternatives: 17 Best Sites & Apps Like Quadpay

Jetty

Launched in 2015, Jetty provides renters insurance policies customized to meet your needs, along with Power-Ups. The company only offers insurance to those who live in one of its partner properties.

Launched in 2015, Jetty provides renters insurance policies customized to meet your needs, along with Power-Ups. The company only offers insurance to those who live in one of its partner properties.

Jetty brings a new approach to renters insurance, and its easy online application makes it easy to get started. Even though renters insurance has been offered online by mainstream insurers for decades, Jetty’s provides detailed coverage information.

While Jetty is increasingly focused on online services, it also has a team of insurance experts on hand to assist you. In this way, it differs from other apps like Flex – Rent.

Jetty offers renters everything they need in one place. The company provides renters insurance, security deposits, and guarantor services under one roof.

Additionally, it provides other services that enable renters to secure deposits and avoid late payment fees.

A 17.5% fee is charged by Jetty on its customers’ security deposits. In addition, Jetty will provide guaranty for its customers’ leases for 5% to 10% of the annual rent.

In case you are searching for a competitively priced service provider, with excellent reviews, Jetty has a lot to offer. Even though it doesn’t offer many discounts, it offers renters insurance rates that are comparable to the industry’s best.

Jetty offers the benefits of both online and conventional insurance companies, offering competitive rates and outstanding customer service.

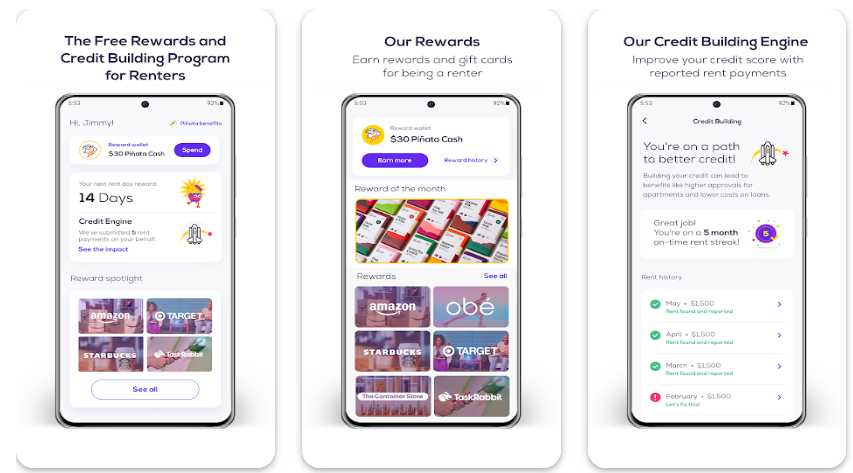

Pinata

Piñata offers free rewards when you pay your rent through the app. You can pay your rent as usual and earn rewards.

Piñata offers free rewards when you pay your rent through the app. You can pay your rent as usual and earn rewards.

Pinata is committed to building credit for renters by reporting on-time rent payments to the three major credit reporting agencies. It may also offer discounts and rewards to renters. There is no charge for renters to use the app.

The low credit score of a renter can be a barrier for those hoping to buy a home or purchase a vehicle with a loan.

Piñata membership earns you Pinata Cash on your rent day, helps you build your credit, and allows you to earn rewards on countless deals.

When you open your account, you’ll receive a $30 e-gift card and your first Pinata Cash. You can use that money to purchase rewards from popular brands.

Circa

Circa simplifies the process of paying rent. Using Circa’s flexible payment plan, you can pay in one, two, or four installments. You can pay directly from your bank account or by cash at local retailers.

Circa simplifies the process of paying rent. Using Circa’s flexible payment plan, you can pay in one, two, or four installments. You can pay directly from your bank account or by cash at local retailers.

You can pay with Circa for no extra charge by paying in full at the start of the month. There is a nominal transaction fee associated with flexible plans. Also, you can change your monthly plan one business day prior to the payment due date.

Circa reminds you to make your payments, making sure you are paying on time. Circa keeps track of your lease details and payment history conveniently.

It simplifies rent collection by offering residents greater flexibility and more control. Circa’s flexible payment options, credit bureau reporting, payment plans for back rent, streamlined communication, and many other features make it an ideal solution for residents and properties.

Other Flex – Rent Alternatives

- Till

- Stake

ALSO READ: –

- 11 Zip Pay Alternatives (Buy Now, Pay Later Apps & Sites)

- 11 Apps Like Sezzle (Buy Now Pay Later Alternatives)

- 21 Best Sites Like Fingerhut to “Buy Now Pay Later” with No Credit Check

Frequently Asked Questions (FAQs)

What is Flex app?

Flexible is an app for iOS and Android aimed at simplifying the renting process. It is similar to a credit card for rent, but without the steep fees. Ideally, renters would be able to pay on a weekly or bi-weekly period, as they prefer.

What is Flex Rent payment?

With Flex, rent payments can be made in smaller installments, Flex gives you more flexibility in your budget and makes it easier to pay large amounts of money every month.

How does Flex Rent work?

As soon as you have been approved for Flex Rent, you can schedule your payments to avoid having to pay all of your rent on the same day. The rent is instead paid in two installments every month on two different dates.

Flex will pay your rent in full on time, so you won’t have to worry about late fees. Whenever you make a Flex payment on time, this builds your credit history.

How to contact Flex – Rent customer service?

If you want to contact Flex rent payment customer service for any reason, you have to submit a request online by filling out a short form.

So, this was the list of the best renting apps like Flex – Rent. The apps mentioned above offer installments on rent and allow you to pay when it’s convenient for you.

Thanks to the existence of multiple apps like Flex – Rent has ensured that pay rent in installments without burdening the monthly budget. These apps have become more accessible to millions of users across the world.

Besides the apps mentioned above, there are various apps on the market that offer renting installments without any extra charges.

A growing number of consumers have become familiar with the technology and have adopted it, the market has grown rapidly and has attracted several new Flex – Rent alternatives in recent years.

Therefore, check out the alternatives to Flex – Rent in the market along with the above-listed apps and see which one of them perfectly meets your requirements.