Eventually, many people consider evaluating their budgets and figuring out how to save money. You can lower your monthly bills very easily, and even without doing anything yourself. Just download apps like Truebill that help you save money.

You might also have forgotten how many subscriptions you have, making you pay for subscriptions that you are not using. Even if you are aware of the number of services you are subscribed to, it may not be feasible for you to contact them to negotiate the subscription fees or bills.

If you can’t bear the thought of getting in touch with your subscription service, cable provider, or cellular provider to save money on your subscription, apps similar to Truebill can handle all of that for you.

Isn’t it time to use technology and smartphone to save money? This article will help you know what Truebill does, why you might find it useful, and what are Truebill alternatives available on the internet.

About Truebill

The Truebill service allows users to save money on their monthly bills. With Truebill, you can do a lot, allowing you to save money and keep track of your spending. There are both free and paid versions of the app. In our opinion, this is one of the most elegant and helpful budget tracker apps out there. Despite Truebill’s many features that can save you money, its main purpose is to negotiate your bills. This service is effective, but you should know it costs 30 percent of the savings per year, paid in advance.

Truebill advertises that it is a free service. This depends on your perspective. Truebill doesn’t charge a fee upfront to lower your bills, but you still won’t get the savings if you don’t compensate the company.

Each time a Truebill user saves a dollar, 40% of that savings is charged as a fee by the app. Savings fees are charged once the savings are secure, and are charged on an annual basis. Thus, if Truebill saves you $1000 over the course of a year, Truebill charges you $400. Truebill does not charge you a penny if you cannot save money.

Simply take a picture of a bill to add it to Truebill. Truebill’s bill negotiation team is ready to assist you in finding additional savings. Your monthly bills will then be negotiated towards getting a lower interest rate or one-time credit. It monitors your subscriptions and cancels them if you are no longer using them. According to Truebill, above 80% of people forget about their monthly subscriptions, and Truebill will find and cancel them on your behalf. The service is only available to Truebill premium subscribers.

With the Truebill money management app, you’ll be able to keep track of all your money, credit, investments, and upcoming payments. Your bills will be prioritized if you do not have enough cash. Truebill categorizes your spending as well, allowing you to see how you spend your money typically and find spots for savings. It is also convenient to see your monthly spending, which makes tracking your progress easy.

Smart Savings on Truebill makes it easy to determine how much money you should save each month to reach your savings goal without sacrificing the ability to pay your bills and expenses at the same time.

It lets you set specific requirements to meet your savings goals preventing overdrafts or future borrowing.

17 Truebill Alternatives To Save More and Spend Less

Saving money is not as easy as it used to be. We live in an era in which a mobile app can be used to save and track money. You can accomplish your financial goals through apps like Truebill. You can find hundreds of apps on the internet that find all subscriptions and cancels them and save your money, but you should choose the best one to use, not only saving you money but also helping you to spend your money appropriately where it is needed.

In order to make your life easier, we’re sharing with you 17 budgeting apps. If you want to manage your money better, there is no need for you to do it alone since a simple app like Truebill can help you. So let’s get started.

Mint

Mint helps you make informed, data-driven choices about your finances. Using this application, you are able to view and manage a credit card, checking, savings, and investment accounts, giving you a comprehensive overview of how your finances are doing.

Mint helps you make informed, data-driven choices about your finances. Using this application, you are able to view and manage a credit card, checking, savings, and investment accounts, giving you a comprehensive overview of how your finances are doing.

In addition, Mint offers free credit reports and ways to improve your score or improve it if you have a bad credit score. Furthermore, you can compare credit cards, investment portfolios, and bank loans.

Mint offers a full picture of your cash flow, helping you to understand your finances and how to manage them effectively. You can also set up special notifications so you never miss a bill and regularly monitor any subscriptions you may have. It is even possible to get notified about price increases for any subscriptions you have.

By customizing your budget, you can keep track of and reduce spending, as well as debt. Furthermore, it is free, as its revenue comes from third-party partners.

Whenever a transaction is made, it is automatically captured and categorized. In this way, Mint keeps track of your spending patterns and builds a budget. Moreover, it generates graphs on the iPad showing your financial picture and cash flow. There is a password protection feature that keeps your information secure, and Mint offers the option of deactivating access from your phone.

Stash

The Stash platform was launched in 2015. The platform focuses on assisting young investors in managing their money efficiently to become financially successful. In order to achieve its mission, Stash focuses on educating its users about a wide range of investment options and topics related to finance. Unlike other investment platforms like Truebill, Stash keeps it simple and flexible with the option to choose investments yourself or opt for a fully automated Smart Portfolio.

The Stash platform was launched in 2015. The platform focuses on assisting young investors in managing their money efficiently to become financially successful. In order to achieve its mission, Stash focuses on educating its users about a wide range of investment options and topics related to finance. Unlike other investment platforms like Truebill, Stash keeps it simple and flexible with the option to choose investments yourself or opt for a fully automated Smart Portfolio.

In addition to this, Stash offers a Stock-Back program, through which they reward users for their spending. When you use your Stash debit card, all qualifying purchases will earn you a percentage of bonus stocks. When you make a purchase at a retailer on Stash’s investing platform, you will automatically receive a percentage of that retailer’s stock. You will get a percentage of your purchases back in an ETF that Stash supports.

As a whole, Stash is an excellent option for helping new and young investors manage their finances efficiently, and the subscription model allows it to become more affordable when your investment account balance increases.

A lot of the features that Stash offers are geared towards investing. This app doesn’t have the same budgeting features as similar budgeting apps Truebill. Nevertheless, if you want to manage all aspects of your finances in one app, there is no better app than Stash.

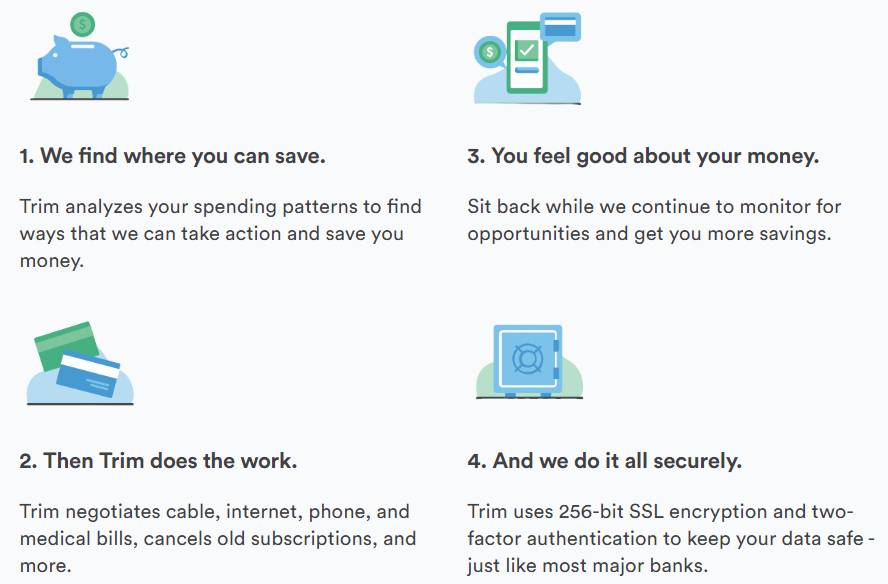

Trim

Trim proactively negotiates for you with companies to save you money on bills and reduce your credit card interest rate.

Trim proactively negotiates for you with companies to save you money on bills and reduce your credit card interest rate.

The program will analyze your spending behaviors and suggest ways in which you can save money. The app utilizes 256-bit SSL encryption and two-factor authentication in order to protect your data from hackers and fraud.

Trim offers many free services, however, it takes 15% of what you save in a year through its services. If you don’t save money, the service is free.

With Trim, your bills credit card interest, subscriptions are automatically negotiated. Install the Trim app and Trim will handle everything, so you don’t have to waste time contacting companies to reduce bills. With multiple levels of security, it provides high levels of protection for your information.

In many ways, Trim is similar to other Truebill alternatives. It works by signing up, linking your bank account, etc. Nonetheless, Trim stands out because it is actively helping you cut spending specifically by canceling unwanted subscriptions and bargaining with your bill companies.

The truth is that it’s easier now than ever before to end up paying more for subscription fees than you realize. Consider Amazon Prime, Netflix, or HBO subscription, for example. The other possibility is that you forgot to cancel your Hulu subscription. There is a problem with subscription-based services, so the Trim app is here to make the cancellation for you.

Trim analyzes transactions from your linked bank account and credit card accounts. Trim identifies subscriptions that are recurring With Trim, you’ll know exactly what it costs. You can cancel services by selecting them. You can cancel them with Trim and it will keep you informed.

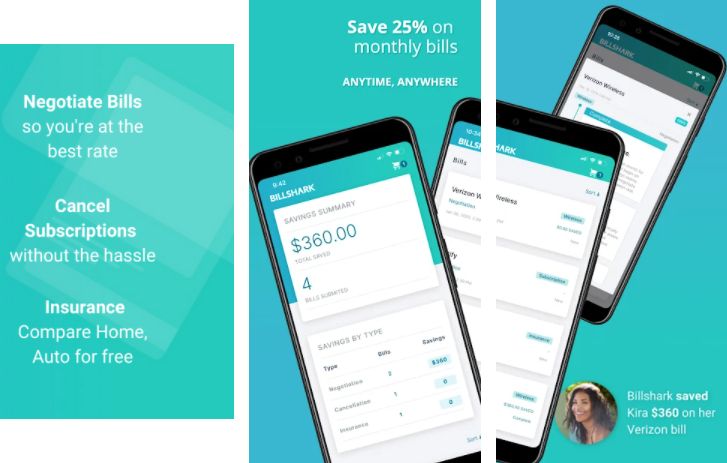

Billshark

Billshark streamlines the bill negotiating and cancellation process, allowing users to focus on more productive and long-term goals. Billshark has a 90% bill negotiation success rate for customers with subscriptions to cable TV, wireless phone, satellite television and radio, internet, and home security.

Billshark streamlines the bill negotiating and cancellation process, allowing users to focus on more productive and long-term goals. Billshark has a 90% bill negotiation success rate for customers with subscriptions to cable TV, wireless phone, satellite television and radio, internet, and home security.

Billshark needs your account information in order to negotiate with your provider. Billshark has a safe and dependable service. Bank-level tech is used by the company for payment submissions and negotiators are given very little of the customer’s personal details. Billshark never gives your personal information to anyone without your consent.

Billshark has a calculator that shows how much you can save with its service. Identify which subscription-based services you want to save money on and select a provider. Billshark lets you upload images of the bills for negotiation on their Android/iOS app and website.

You will be notified by email and call regarding the outcome of the negotiation, which will include savings totals and the date on which savings will become effective (usually within a billing cycle).

Whenever you save money with Billshark, a 40% fee is charged, and it occurs every month. In the event that you save $100 per year on your broadband bill, you will have to pay $40 per month to Billshark.

Billshark charges a flat fee of $9 for any subscription-based service cancellations, and you may be eligible for a refund of any unused service credits. With the same fee, you can increase or decrease your subscription level. Bill shark has every functionality you can expect on other apps like Truebill which makes the app stand out.

Emma

Emma gathers all your financial information together, allowing you to better understand your spending habits, and provides you with tools for making more informed financial decisions.

Emma gathers all your financial information together, allowing you to better understand your spending habits, and provides you with tools for making more informed financial decisions.

Therefore, with this app, you can manage bank accounts, savings and investments, credit cards, cryptocurrencies, and pensions in one place. With Emma’s technology, you can categorize your transactions and track them more efficiently.

Keeping track of recurring payments can be challenging, but Emma makes it easier. Emma is a is the best app that finds all subscriptions. It analyzes and identifies your subscriptions and displays the transaction history of all subscription providers so that you can spot price increases and discontinue unnecessary subscriptions.

An important feature of the app is that it displays a list of active and inactive subscriptions. In this way, you will be able to identify services you are paying for that you have stopped using or thought you canceled. In addition, you are informed about the change in subscription fees from the last time.

You can even link Emma to cryptocurrencies like Bitcoin, which is a rare feature in personal finance apps like Truebill. The Emma app has a paid version called Emma Pro that offers additional features.

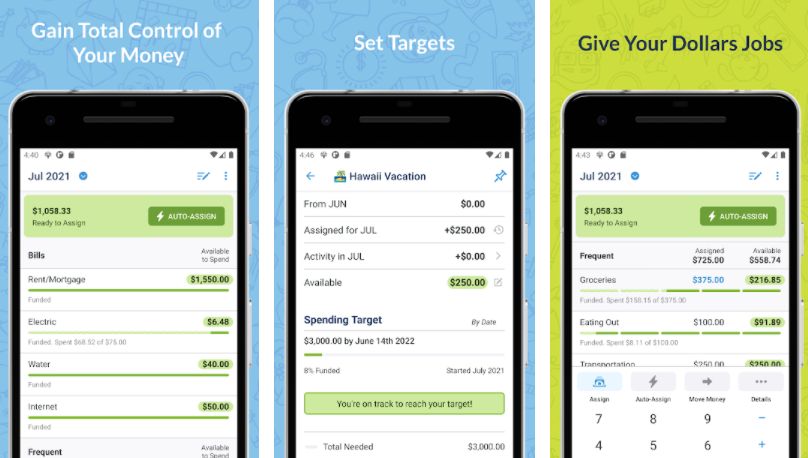

YNAB

With YNAB, users can not only create a budget but also save money as well. Budgeting is made easier with YNAB. The app’s users actively manage their budgets by creating goals, adding expenses, and adjusting them accordingly. As a starter, you can choose from a list of default categories, and you also have the option to create your own.

With YNAB, users can not only create a budget but also save money as well. Budgeting is made easier with YNAB. The app’s users actively manage their budgets by creating goals, adding expenses, and adjusting them accordingly. As a starter, you can choose from a list of default categories, and you also have the option to create your own.

By linking your accounts, you can automatically import your transactions. The transactions can also be entered manually. With the app, you can easily see the amount of money you have available to spend in each category.

YNAB is useful for tracking other financial accounts, such as investment accounts. It does require more effort to track expenditures, in comparison with other budgeting apps like Truebill. It may make more sense to use other apps similar to Truebill if you’re interested in tracking investments.

YNAB enables you to manage your current priorities and manage your current finances. You can begin by allocating the money you have toward your basic needs, like bills or groceries.

Both the website and app of the YNAB resemble a spreadsheets interface; it takes a bit of time and effort to learn compared to other Truebill alternatives. Moreover, YNAB is limited in terms of features in comparison to some competing apps similar to Truebill.

Spendee

Spendee provides a great way to manage your income and expenses, particularly if you have difficulty tracking your spending and want to be aware of how much you’re spending.

Spendee provides a great way to manage your income and expenses, particularly if you have difficulty tracking your spending and want to be aware of how much you’re spending.

Using this app is easy, customizable, inexpensive, and costs only a few dollars per month to sync transactions and income easily and accurately, eliminating the need for manual reporting. This app is a valuable money management tool overall.

Under Overview, Spendee provides you with a list of all your transactions, your balance, your earnings and expenses, and monthly graphs that visually illustrate how your money is spent.

Make your shopping experience less stressful by budgeting effectively. Spendee makes it easier to stick to your budget. Budgets can be set for different aspects of your spending (for example, food, clothing, entertainment), you can receive alerts when your budget is approaching, and you can track your daily spending in real-time.

When you’re busy with a lot of commitments, you might forget to pay your mobile recharge, cable, broadband, electricity, or credit card bill. It happens to everyone. Spendee notifies you when due dates are approaching in advance so you can avoid this.

Not only can you link your bank accounts, but also your cryptocurrency wallets and enter expenses manually for more accurate financial tracking. Spendee account can be linked to multiple users, making it an ideal tool for family members or friends.

- You might be interested in – 12 Apps Like SoLo Funds to Lend & Borrow Money (2022)

Qapital

Savings have never been easier with Qapital, an app that automates savings. It allows you to set unlimited savings levels for anything. Qapital is a paid service, however, Basic subscriptions are just $3/month.

Savings have never been easier with Qapital, an app that automates savings. It allows you to set unlimited savings levels for anything. Qapital is a paid service, however, Basic subscriptions are just $3/month.

Qapital keeps track of your goals and transfers your savings automatically, so you can relax while your account grows. You can choose from several membership options. Choosing a higher tier of service gives you the option of a checking account and investment account. Since its launch, a million people have used the service to manage their finances more effectively.

Using the app is a great idea if you’ve had trouble minimizing expenses and saving money because it automates the process. The app serves as a micro-savings tool, allowing users to make small savings by making purchases and performing other financial and personal tasks. In addition, it sets savings goals for you and makes it easier for you to achieve them.

Basic members of Qapital save $1,500 annually, Complete members save $4,300 annually, and Master members save $5,000 annually, claims the Qapital website. Qapital can help you save money, but ultimately it depends on what goals you set and the rules you set for automation.

You may want to check out Qapital if you’re seeking ways to save money easily. The app makes saving enjoyable and straightforward.

PocketGuard

PocketGuard is a financial app that provides a comprehensive view of users’ spending and income in order to help them save money. This app is perfect for consumers looking for a clear picture of what their remaining funds are once expenses and bills are paid.

PocketGuard is a financial app that provides a comprehensive view of users’ spending and income in order to help them save money. This app is perfect for consumers looking for a clear picture of what their remaining funds are once expenses and bills are paid.

PocketGuard is created for consumers who want to be more in control of their monthly expenses and save more money at the same time. For purchase tracking, you make sure your credit and debit cards are linked in the app. Once this is done, all of your purchases will be uploaded automatically.

Savings goals can be set within the app so you can ensure you are on the right track towards reaching them. For budgeting enthusiasts who like to use spreadsheets, the PocketGuard Plus subscription lets you export data to Microsoft Excel too.

Furthermore, when a user completes a profile, PocketGuard tailors offers more affordable bills like cable and cell phone service. Subscription services can also be tracked in the app in order to ensure you’re not paying for something you don’t use. So, if you are looking for an app that finds all subscriptions PocketGuard can be a great Truebill alternative app. Users can save money on their monthly expenses by utilizing these features.

A paid subscription known as PocketGuard Plus is available in addition to the free version of PocketGuard. The app is free to download, you can sign up and access many of its features for free.

For features like exporting transactions, unlimited goals, splitting transactions into different categories, and categories for your budgeting, PocketGuard Plus may be the best option for you.

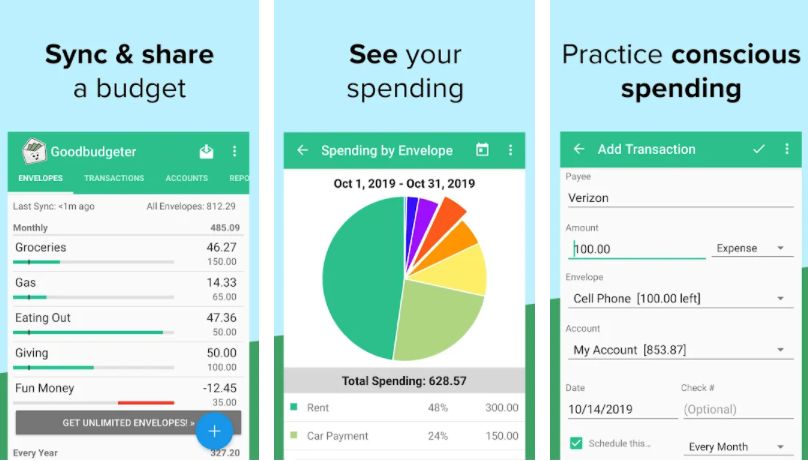

Goodbudget

Goodbudget lets you track your expenses and manage your money, which is excellent for home budgeting. Using this planning tool, you can keep track of your bills and financial activities. The tool is designed for real-time tracking. Additionally, the app syncs across Android, iPhone, and the web, so you can share your budget with others.

Goodbudget lets you track your expenses and manage your money, which is excellent for home budgeting. Using this planning tool, you can keep track of your bills and financial activities. The tool is designed for real-time tracking. Additionally, the app syncs across Android, iPhone, and the web, so you can share your budget with others.

The app and website allow you to customize your spending and saving. Free membership is an excellent option for people who are just starting out to manage their financial affairs, but people with a larger budget might consider upgrading to higher plans.

There is no automatic synchronization between your bank account or credit cards, so all transactions must be manually entered in order to maintain accuracy.

Goodbudget enables you to monitor how much you earn and spend, and the fluctuations over time. The app has simple graphs that provide insight into how you spend your money.

Goodbudget stands out for its use of the envelope system for users to organize and budget monthly expenditures.

Aside from a neat interface Goodbudget offers a variety of resources such as podcasts, structured courses, and articles to assist you in getting out of debt and dealing with life’s biggest challenges, like starting a family, settling down, going out to rent, or buying a home, or saving money for college.

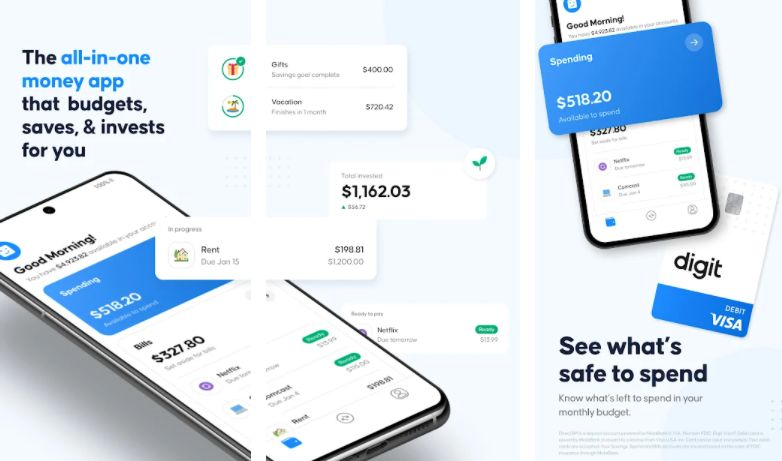

Digit

Digit simplifies the financial goal-setting process for consumers by helping them save and invest money. By automating tasks, it eliminates manual effort, making it possible for the user to achieve their goals more easily.

Digit simplifies the financial goal-setting process for consumers by helping them save and invest money. By automating tasks, it eliminates manual effort, making it possible for the user to achieve their goals more easily.

For those who wish to use budgeting apps like Truebill that focus on helping you save, paying down debt, and investing in one place, Digit can be a great option. For $5/month, users may find it worth it to avoid the tedious process of manually saving and managing their investments.

Digit analyzes your bank account balance every day for savings opportunities, allowing you to save more. By accumulating three consecutive months of savings with Digit, you’ll be eligible for a 0.10% Savings Bonus.

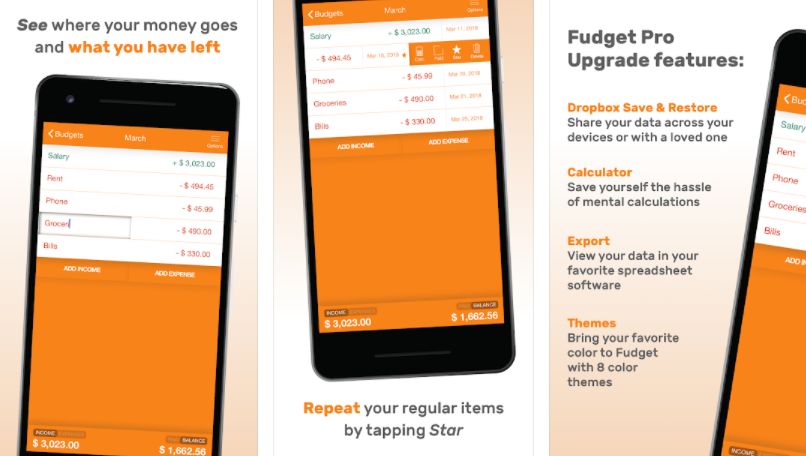

Fudget

Fudget is a great alternative to Truebill if you don’t want to sync your financial accounts and want a simple, calculator-like interface instead of complicated features.

Fudget is a great alternative to Truebill if you don’t want to sync your financial accounts and want a simple, calculator-like interface instead of complicated features.

With Fudget’s simple interface, you can keep track of the money you receive and spend and keep an eye on your balance. Fudget does not even have a category for budgeting. The Pro account gives you access to exporting budgets, as well as other perks.

It’s not the best app if you wish for categorization of expenses, insights or any other functionality. Unless you are comfortable with logging every expenditure, you should probably look at other apps like Truebill.

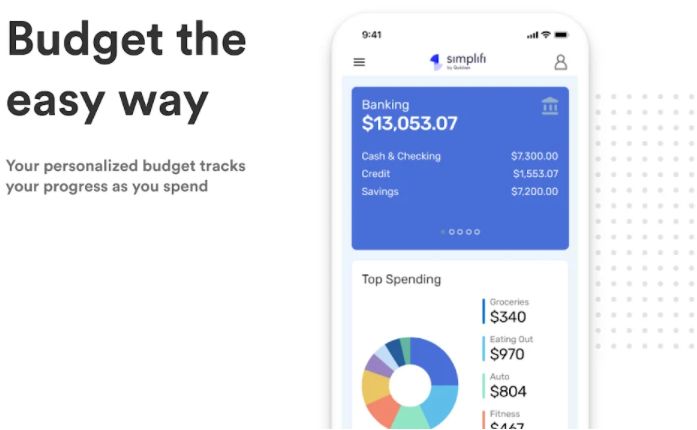

Simplifi

Simplifi is a financial app that helps users stay on top of their finances and help them see their finances from a broader perspective.

Simplifi is a financial app that helps users stay on top of their finances and help them see their finances from a broader perspective.

A number of features make Simplefi stand out. There is an excellent net worth tracker which lets you view your net worth broken down by account or all at once.

Additionally, the app has a simple budgeting tool called a spending plan that allows users to keep track of income, fixed bills, and personal spending.

When it comes to spending reports, splitting transactions, or ignoring specific transactions (like reimbursements for work expenses), the app is extremely user-friendly.

In addition to the mobile app, the desktop website is also available. Bill-tracking in Simplifi app is less sophisticated than on the Truebill app, but it can still be included in monthly expenses. It is possible to add notes and attachments, and split transactions.

Other Apps Similar to Truebill

Also Read: –

- 16 Best Sites Like Afterpay (Alternatives with No Credit Check)

- 21 Best Sites Like Fingerhut to “Buy Now Pay Later” with No Credit Check

- 11 Apps Like Sezzle (Buy Now Pay Later Alternatives in 2022)

- Quadpay Alternatives: 17 Best Sites & Apps Like Quadpay (2022)

- 11 Zip Pay Alternatives (Buy Now, Pay Later Apps & Sites)

Final Words

Bill negotiation services like Truebilll are based on the idea that people overpay for subscriptions, but lack the time to search for better offers with less prices or negotiate lower prices with service providers. In lieu of contacting providers on their own, customers may authorize apps like Truebill to get in touch with companies or service-provider to lower their bills on their behalf.

Spending before saving is a habit, and apps like these can help you become more aware of it. Furthermore, they’re an excellent option if you want to save money on utility bills like internet, cable, phone, subscriptions, and any other bills you may have.

If you know other better apps like Truebill, let us know the name in the comments section below.