When choosing Quadpay, you may also wish to compare similar alternatives or competitors to determine which one offers the best service. While researching Quadpay alternatives, it is also important to think about the ease of use and reliability of that platform. So, in this article, we have created a list of options that they deemed to be the best alternatives to Quadpay.

About Quadpay

As its name suggests, Quadpay allows you to split an online payment into four equal payments at no interest. Quadpay is a popular payment platform that you can use to pay for your online purchases as soon as you signup and link your payment through a credit or debit card. From the date of purchase onward, Quadpay will charge your payment source four times.

Quadpay doesn’t set a minimum purchase amount for its users, but each merchant has the option of setting a maximum and minimum qualifying purchase amount. Your items will ship with QuadPay the same way they would with any other method of payment.

Users of Quadpay have a balance available for any purchase they wish to make. Although you can buy items or shop at anywhere you desire that accepts Quadpay, your available balance determines how much you can spend. When you make new purchases or payments, you can check your balance on the Quadpay app, similar to a credit card.

Apps Like Quadpay: Best Buy Now Pay Later Apps Similar To Quadpay

Afterpay

Also Read: –

- 16 Best Sites Like Afterpay (Alternatives with No Credit Check)

- How to Delete Afterpay Account (Easy Guide)

In addition to offering interest-free EMI online, they also offer it offline. Those of you who shop both online and offline often should consider Quadpay’s purchase now and pay later service. It is a service that will be of great benefit to you.

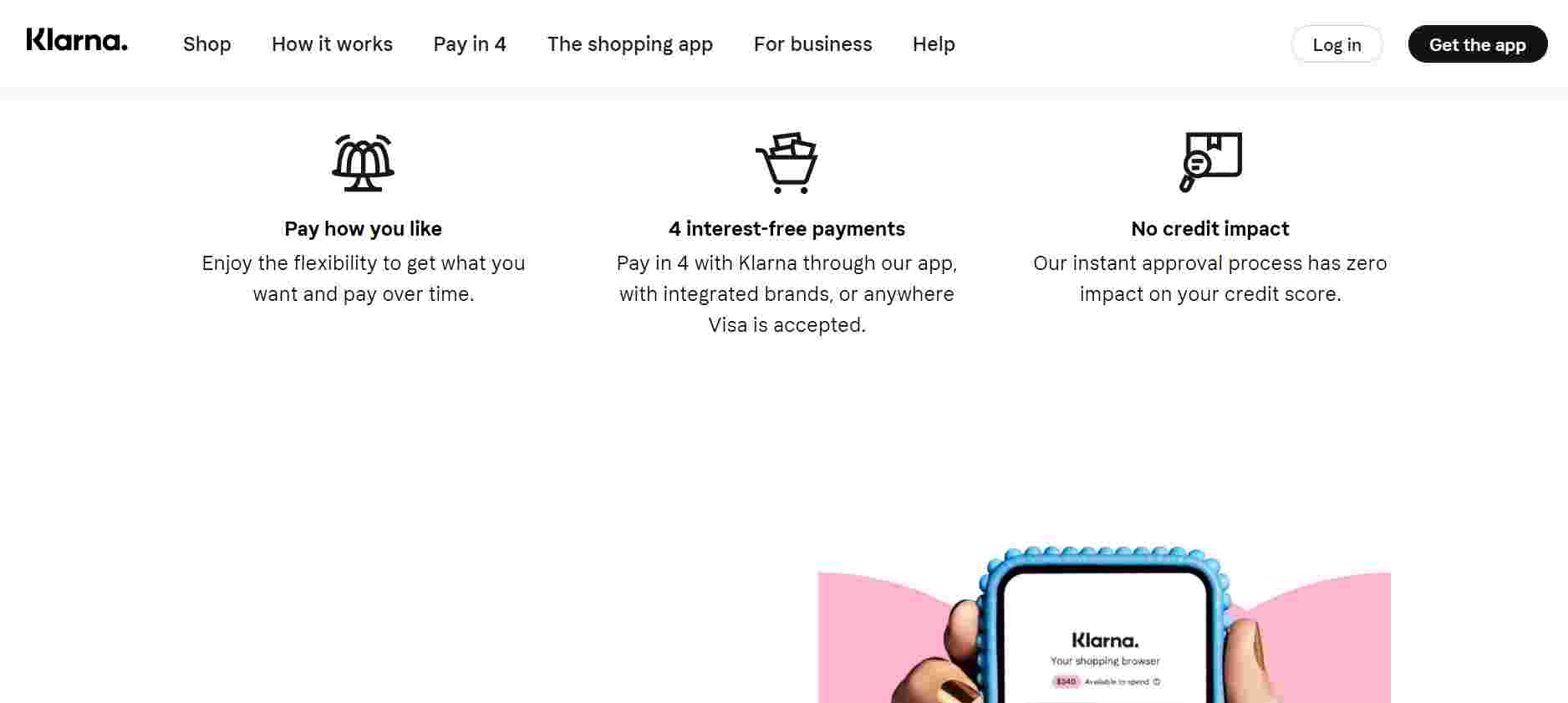

Klarna

Klana is another platform that operates in many countries including the USA, United Kingdom, Australia, Canada, Germany, France, Italy, New Zealand, and more. Customers have the option of picking their payment method from 250,000 merchants in 17 countries offered by the company.

Klana is another platform that operates in many countries including the USA, United Kingdom, Australia, Canada, Germany, France, Italy, New Zealand, and more. Customers have the option of picking their payment method from 250,000 merchants in 17 countries offered by the company.

Klarna was introduced in 2005 and currently, over 90 million consumers use this platform worldwide. The cherry on top is that there are no interest fees involved, and your credit score is not affected if you pay your installments on time. Klarna’s best feature is that you can purchase products with just one click. Klarna offers its iOS and Android apps for online shopping.

ALSO READ: –

Sezzle

The next one on this list for the best alternative apps like Quadpay is Sezzle. It allows you to spread your payments over 4 interest-free months. Users can shop instantly on over 27,000 stores and sites thanks to Sezzle, which is user-friendly and quick to approve. The Sezzle credit can be used on a variety of platforms by anyone.

The next one on this list for the best alternative apps like Quadpay is Sezzle. It allows you to spread your payments over 4 interest-free months. Users can shop instantly on over 27,000 stores and sites thanks to Sezzle, which is user-friendly and quick to approve. The Sezzle credit can be used on a variety of platforms by anyone.

It is a perfect alternative to Afterpay, as you can be sure that it will not affect your credit. The site offers a variety of options for paying in monthly installments. A four-payment EMI allows you to make the purchase interest-free. By separating payments into a number of equal payments spread along with interest, buyers are enabled to gather all the products they desire from all the stores and sites.

Affirm

Affirm is another alternative to Afterpay that has no hidden costs or late fees. There is a wide range of products available for you to pick from, so choose the one that best fits your needs to purchase and pay later. You will find the option at checkout if you wish to use Affirm to pay through installments.

Affirm is another alternative to Afterpay that has no hidden costs or late fees. There is a wide range of products available for you to pick from, so choose the one that best fits your needs to purchase and pay later. You will find the option at checkout if you wish to use Affirm to pay through installments.

In order to complete the signup process, you need only provide a few pieces of information. It does not require a credit check, unlike most of the other websites that ask for dozens of documents before giving the approval.

- ALSO READ: – How to Delete Affirm Account (Complete Guide)

Zip

ZIP is often used as a substitute site similar to Quadpay. Additionally, this would enable you to keep your purchase and make a payment later. The platform does not charge hidden fees or annual costs, but it happens occasionally when you don’t pay on time.

ZIP is often used as a substitute site similar to Quadpay. Additionally, this would enable you to keep your purchase and make a payment later. The platform does not charge hidden fees or annual costs, but it happens occasionally when you don’t pay on time.

ZIP payment is integrated into almost all popular sites, and payment can be made instantly without waiting days for approval. Zip payment platform offers a variety of products via buy and pay later including groceries, electronics, and fashion, as well as thousands of offline shops and stores.

You can pay with Zip Pay or Zip Money depending on the account limit. When you use Zip Money purchase of over $1000, there is no interest for three months. ZIP has over two million Australian and New Zealander users that are satisfied with the service provided by the company.

Also Read: –

- Zip (Quadpay) Alternatives: 17 Best Sites & Apps Like Zip Quadpay

- How to Delete Zip Account (EASY GUIDE)

Splitit

You can use Splitit as an alternative to Quadpay for payments on purchases and bookings over time. Basically, it is a way for users to split up their purchases into smaller installments for easier repayment. To spend on the things you need, the service offers a higher limit without any fees.

You can use Splitit as an alternative to Quadpay for payments on purchases and bookings over time. Basically, it is a way for users to split up their purchases into smaller installments for easier repayment. To spend on the things you need, the service offers a higher limit without any fees.

With Splitit flexible payment plans, people can select a plan that meets their budget expectations and pay without incurring interest. Splitit’s website and quick checkout process make it an easy way for people to explore the realm of “buy now, pay later” services. Splitit allows the user to split the total up to 24 installments or pay in installments over the course of a fixed period of time.

Partial.ly

Partial.ly is a Quadpay alternative worth taking a look at. The Partial.ly payment portal allows retailers to offer customers more flexible payment plans by automatic payments over time. By joining Partial.ly, retailers can access a flexible payment service.

Partial.ly is a Quadpay alternative worth taking a look at. The Partial.ly payment portal allows retailers to offer customers more flexible payment plans by automatic payments over time. By joining Partial.ly, retailers can access a flexible payment service.

Unlike other companies, Partial.ly focuses its services on retailers, rather than consumers. It is aimed at businesses that can greatly benefit from enhanced cash flow through flexible payment options.

Despite some transaction fees, there are no hidden fees on Partially, and transactions are presented upfront. Providing flexible plans for payment for products and services will allow customers to pay at the rate that suits their finances.

Viabill

With Viabill, you pay for each item you want in four installments without interest. This allows you to get what you want now and pay later.

With Viabill, you pay for each item you want in four installments without interest. This allows you to get what you want now and pay later.

Viabill’s monthly installment is always deducted automatically on the same day every month, without interest or hidden fees. Since no contract is involved, shoppers will not be charged any interest for installment payments. Whether you are a seller or a customer, ViaBill offers an easy way to pay now and pay later.

Through ViaBill, consumers can find affordable, transparent financing options that are easy to understand.

OpenPay

One of the most straightforward yet very intuitive apps like Quadpay is OpenPay. Presently, a number of online retailers offer the Openpay service. With OpenPay, you can purchase items up to $10,000 and finance them for up to 12 months. After submitting your details, a verification process will be started, which can be done using the app, in-store, or during checkout.

One of the most straightforward yet very intuitive apps like Quadpay is OpenPay. Presently, a number of online retailers offer the Openpay service. With OpenPay, you can purchase items up to $10,000 and finance them for up to 12 months. After submitting your details, a verification process will be started, which can be done using the app, in-store, or during checkout.

OpenPay’s retail partners will allow you to shop in-store or online once your application is approved. Choose a payment plan that fits your budget; make the first payment today, the rest in a fortnight or a week.

ZestMoney

With ZestMoney, consumers can receive instant EMIs options that can be used on more than 1000 websites and apps and even if they don’t have a credit card.

With ZestMoney, consumers can receive instant EMIs options that can be used on more than 1000 websites and apps and even if they don’t have a credit card.

Established in 2015, ZestMoney is the top fintech company serving the Indian consumer lending market. The goal of ZestMoney is to make a meaningful difference in the lives of more than 300 million families across the country who currently do not have access to credit cards or other formal financing options due to poor credit histories.

Signing up with ZestMoney and completing the KYC process is all that is needed to access the ZestMoney Credit Limit. As soon as a user’s application is approved, he will be assigned a credit limit, from which he will be able to purchase goods and services from ZestMoney’s 3000+ merchant partners.

With ZestMoney, you can shop at your favorite brands including Amazon, Flipkart, NestAway, UpGrad, Myntra, SleepyCat, Xiaomi, and others.

Laybuy

Similar to Quadpay, Laybuy offers installment payments. Residents of New Zealand, Australia, and the UK can use this service to buy countless items online or in-store with installment pricing. Now, you can manage your budget and payments more easily. Check your balance, pay off your orders before the due date, or just get notified of upcoming payments.

Similar to Quadpay, Laybuy offers installment payments. Residents of New Zealand, Australia, and the UK can use this service to buy countless items online or in-store with installment pricing. Now, you can manage your budget and payments more easily. Check your balance, pay off your orders before the due date, or just get notified of upcoming payments.

Laybuy spreads payments into 6 installments. By doing so, you ensure that payment depends on your financial stability. If they don’t get paid, they charge you 10% of the total payment. Laybuy is a good choice for consumers who enjoy shopping but lack the financial means to make a big purchase.

Paypal Credit

While not a perfect Quadpay alternative, Paypal Credit does have a lot to offer when it comes to buy now pay later service. The PayPal Credit service is popular and ranks among the top buy-now-pay-later services. It comes from PayPal, as the name suggests.

While not a perfect Quadpay alternative, Paypal Credit does have a lot to offer when it comes to buy now pay later service. The PayPal Credit service is popular and ranks among the top buy-now-pay-later services. It comes from PayPal, as the name suggests.

Paypal Credit is a convenient way to book or buy anything in monthly installments at most popular retailers, such as Walmart, Home Depot, USPS, eBay, B&H Photo Video, Best Buy, Overstock.com, JetBlue Airways, Liquidation Channel, Jewelry Television, and Hotels.com. They offer support for most sites you would expect from a pay-later company.

Since 2000, PayPal Credit has been available to users. The company extended its reach to other countries later on. PayPal Credit is currently available in a number of countries worldwide, including the United States, the United Kingdom, Canada, Europe, and Japan.

Fingerhut

The Fingerhut website offers you all your favorite products for a price you can afford. The platform enables customers to purchase items and account for their monthly bills via a user-friendly interface. With Fingerhut credits, it’s convenient and straightforward to complete a purchase.

The Fingerhut website offers you all your favorite products for a price you can afford. The platform enables customers to purchase items and account for their monthly bills via a user-friendly interface. With Fingerhut credits, it’s convenient and straightforward to complete a purchase.

There are many products from Fingerhut that work over credit and act as saviors for those who are willing to pay less down payment upfront for their products. A huge range of products, the ability to get credit to purchase the stuff, free shipping, discounts, deals, and excellent customer service make Fingerhut a favorite destination for millions of customers.

Atokes

Atokes provides a cost-spreading service with credit limits ranging from $500 to $3,000, with interest-free purchases. Atokes.com offers a wide selection of products from a wide variety of merchants. Decide how much you will pay initially and how many installments you want based on your monthly budget, and then place your order.

Atokes provides a cost-spreading service with credit limits ranging from $500 to $3,000, with interest-free purchases. Atokes.com offers a wide selection of products from a wide variety of merchants. Decide how much you will pay initially and how many installments you want based on your monthly budget, and then place your order.

According to the documents that users submit as proof of income, each user’s monthly credit limit is calculated. This service offers six months of interest-free payments, and for good repayment history, it can be expanded to ten payments.

FuturePay

FuturePay enables you to pay later when you purchase online primarily. No hidden fees or conditions are associated with FuturePay transactions. Online shopping and getting products delivered to your doorstep can only be beneficial to you.

FuturePay enables you to pay later when you purchase online primarily. No hidden fees or conditions are associated with FuturePay transactions. Online shopping and getting products delivered to your doorstep can only be beneficial to you.

Once you’ve completed the purchase, the remaining balance can be paid per month in amounts ranging from $25 to $100. If you prefer to make a full payment, you can do so as well.

You will be charged a $1.50 fee for each $50 balance carried forward from one month to the next. Transparency is what makes FuturePay stand out. It offers low fees and flexible payment terms.

Pay in 4 – Paypal

Paypal, the largest payment platform in the world, offers the Pay in 4 service, a personal installment loan program. For qualifying customers, interest-free financing is available in 4-week installments. It is possible to split payments into four installments. You will not be charged for hidden fees.

Paypal, the largest payment platform in the world, offers the Pay in 4 service, a personal installment loan program. For qualifying customers, interest-free financing is available in 4-week installments. It is possible to split payments into four installments. You will not be charged for hidden fees.

The amount available depends on the customer’s ability to pay and can range from $30 to $600. Pay in 4 is currently only available to PayPal users in the US.

Littlewoods

Known as one of the leading companies like Quadpay in the UK, Littlewoods offers a variety of payment options to help customers shop more easily.

Known as one of the leading companies like Quadpay in the UK, Littlewoods offers a variety of payment options to help customers shop more easily.

It offers the Spread The Cost Interest-Free program, through which buyers can spread the cost over 20 or 52 weeks with 0% interest. Payments for installments can be made monthly so as to fit your budget.

You can also opt for the Buy Now Pay Later option, which offers interest-free payments for 12 months at a rate determined at checkout. These installment options allow you to choose your furniture item and pay the remaining balance over either a four-week or eight-week period.

Frequently Asked Questions (FAQs)

What are the Quadpay Eligibility Criteria?

You must be a U.S citizen aged 18+. Ensure you have a valid, verifiable mobile number. You should have credit or debit cards issued in the United States (not prepaid).

How Quadpay Works?

Upon approval, QuadPay creates a payment schedule based on the order total, and QuadPay deducts your first installment payment from your debit/credit card: The card information you provide is stored for future installment payments, which are automatically deducted every two weeks on your scheduled due date.

Can Quadpay Be Used Anywhere?

Quadpay can be used in-store or online at almost any store that accepts the payment method.

Will Quadpay Increase Credit Limit?

You cannot request a credit limit increase from Quadpay. The limit that Quadpay sets for you is automatically determined by your spending history, how long you’ve been a customer, among other things. Your available balance will replenish faster if you repay your balance early.

What Are Quadpay Merchant Fees?

Quadpay charges a platform fee of $1.00 per installment ($4.00 in total).

When Does Quadpay Charge?

Each installment that is seven days overdue is charged a $7 fee by QuadPay. Afterward, if the account still has not been repaid after 14 days, an additional fee of $7 will be applied. Each order will be charged a maximum of $14.

Does Quadpay Charge Interest?

With Quadpay, you can pay for your installments without incurring interest. Currently, customers who use QuadPay Checkout are only charged late payment fees.

Does Quadpay Affect Credit Score?

A customer’s credit rating is not affected by using QuadPay as QuadPay never performs hard credit checks on them.

Does Quadpay Have A Limit?

Quadpay gives users the option of using any available balance to make purchases. While you can buy anything you want or shop anywhere, you’re limited by how much you have on the Quadpay account.

Final Words

Above, we have shared 17 top alternative sites and apps like QuadPay, some of which you may already be familiar with. Regardless, these are some great buy now pay later services you might want to try on your next purchases.

Whether you stick with Quadpay as your permanent platform for the purchase and pay later service or make the switch to other apps like Quadpay is entirely up to you. Whatever the case, it’s good to know there are plenty of options available.

Note: – All the images, screenshots, and trademarks used in the article belong to their respective websites and owners and we do not claim any right over them.