The needs of consumers are being met faster by technology. Sometimes consumers are unable to purchase things they like because they don’t have ready cash. By offering a payment plan of up to one year, apps like Sezzle makes buying and paying easier, faster, and affordable.

The demand for “buy now, pay later” (BNPL) apps surged following the Corona outbreak. With BNPL apps, consumers can buy an item and make shirt installments later typically over a few weeks or months. The consumer takes these short-term debts in order to satisfy immediate needs/wants.

There has been a trend towards this payment model in electronics, furniture, stores for a while now. In the real world, there are some purchases that are too expensive to pay outright for those needed every day. Split payments, however, have become more popular through BNPL apps like Sezzle.

Therefore, we will show you the best Sezzle alternatives that offer different loan amounts at different interests at no credit check. So that these apps can pique your interest. Keep on reading below to see the top apps or websites like Sezzle.

About Sezzle

Sezzle provides interest-free loans on its platform so you can shop online, make purchases, and pay for them over six weeks in four installments.

When you use Sezzle to shop, you can do so via its app, its website, as well as directly on the website of a merchant. Let’s say you spend $200. The first installment generally amounts to 25% of your purchase, $50 in this case. All three subsequent installments will be for $50 until the full amount is repaid.

If you apply for a Sezzle loan, your credit score won’t be affected since a “soft” credit check is conducted by the company. Despite Sezzle’s no-interest loan policy, they sometimes charge fees. Take the example of a failed debit card payment. You’ll have 48 hours to resolve the issue, such as having enough funds in your bank account to make the payment or finding an alternative way to pay. When your problem isn’t fixed within 48 hours, you’ll be charged $10.

Upon taking out a loan, you agree to repay it in a particular manner. It is free to reschedule one of those payments with Sezzle. There is a $5 fee for each additional rescheduled payment. Sezzle enables you to purchase a product now with only 25% down. In case you’re good at managing your finances and paying your bills on time, Sezzle is a great way to borrow money without paying interest.

The Sezzle loan is essentially equivalent to cash as long as it is paid back within six weeks. They also have an option called “Sezzle Up”. By enrolling in Sezzle Up, your payment history will be reported to the three major credit bureaus, allowing you to build credit free of interest, fees, or debt as long as you pay on time.

Websites & Apps Like Sezzle to Buy Now Pay Later

Affirm

With the majority of Americans using the buy-now-pay-later method, it’s easily understandable why Affirm is popular.

As a consumer lender offering low-interest loans Affirm enables consumers to purchase what they want now and pay it off later. Customers can repay their loans in multiple monthly installments with Affirm.

If you qualify, you can shop up to $17,500 with Affirm, which you can pay over time. You can shop up to $17,500, depending on your eligibility, using Affirm, and spread out the costs over time.

- ALSO READ: – How to Delete Affirm Account (Complete Guide)

Through Affirm, consumers receive credit with no additional fees and require no applications or payment upfront. The personal loans provided by Affirm do not have penalty APRs for late payments.

Payments can only be made in the same amount each month. By doing this, you will not accumulate debt by paying minimums like you would on a credit card.

Affirm offers interest-free personal loans in some cases. More than 159 of Affirm’s vendor partners offer split payment options. However, they are limited to a certain amount.

Consumers can rely on Affirm to get money help while buying something. You can borrow money with a few percentages in interest. Throughout their platform, they offer outstanding loan services that are developed to enhance the shopping experience.

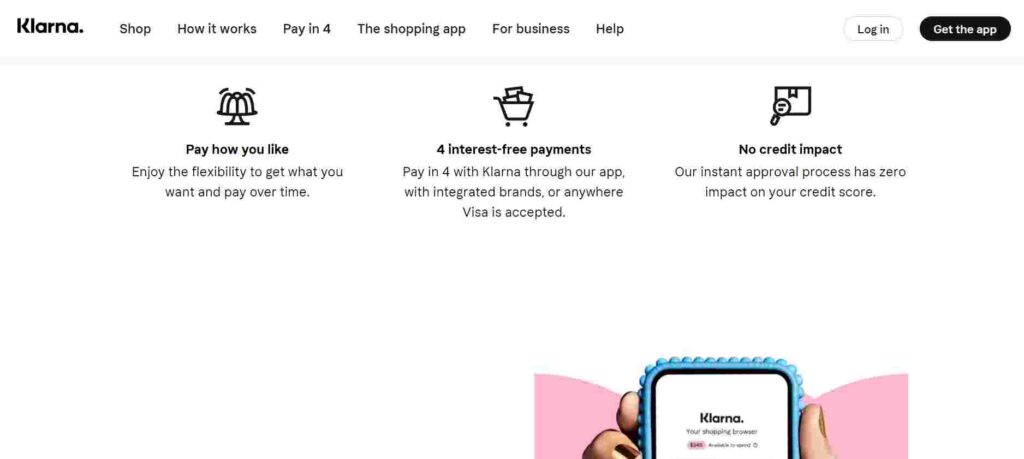

Klarna

Klarna is an app that allows users to buy and pay later. It can be used at any online retailer in the U.S. that accepts debit cards and credit cards. Klarna partners with other merchants to offer it in-store as well.

Klarna is an app that allows users to buy and pay later. It can be used at any online retailer in the U.S. that accepts debit cards and credit cards. Klarna partners with other merchants to offer it in-store as well.

Klarna’s Pay in 4 option lets users pay for purchases in four interest-free installments, which are due every two weeks. Using Klarna Credit, you can pay for purchases in 36 monthly installments. It has a 19.99% APR which is the yearly interest rate in simple words.

You can also make a full payment right away using Klarna’s “Pay Now” functionality. Additional options may be available, like “Pay over 6 months” at a fixed interest rate.

If you are paying in installments, you can use any major debit or credit card on Klarna. After you purchase, automatic payments will be scheduled, and Klarna will inform you by email when your payments are due.

In monthly installment plans, payments can be made with a debit card or bank account. Payments can be made manually or automatically once a bank account is enrolled with Klarna.

One of the most appealing features of Klarna is its interest-free financing. By choosing one of the “Pay in 4” or “Pay in 30” options, you can pay for your order immediately and over the course of time.

If you need to make a large purchase right away, but can’t pay in full right away, apps like Sezzle and Klarna are very helpful. If you choose to use this option, however, make sure you don’t end up with too much debt to repay. Don’t place the order until you’re sure you can pay on time.

You have several choices when it comes to financing with Klarna. It’s wonderful to have the option of paying how you want, and not every BNPN apps provide this option. If you use any of Klarna’s financing options, a soft credit check is performed on you. This will not affect your credit score in any way.

Your credit could be negatively affected by Klarna, in the event that you do not make your payments on time. Credit building won’t be possible with Klarna. Credit bureaus do not receive information regarding Klarna payments.

When you do not make your payment on the “Pay in 4” plan, you will be charged a $7 late fee. You will never be charged more than 25% of your order value for late payments. You won’t be charged any late fees if you choose “Pay in 30 days”, however, you won’t be able to use the service again. Klarna charges interest on monthly payment plans. Additional fees of up to $35 are charged for late-payments and returned payments.

Also Read: –

“Pay in 4” is Klarna’s longest interest-free plan. As a result, you pay the first installment when the merchant completes your order, and then every two weeks thereafter. In total, you pay for your purchase over six weeks.

When making a large purchase, for customers who need some time before making their first payment, Klarna offers an alternative to traditional loans and lending options. Ensure that you understand your options if you are unable to make installment payments for your purchase on time. If you do not, you could be charged a late fee and/or face other problems. With Klarna, merchants have an appealing alternative to apps similar to Sezzle and AfterPay.

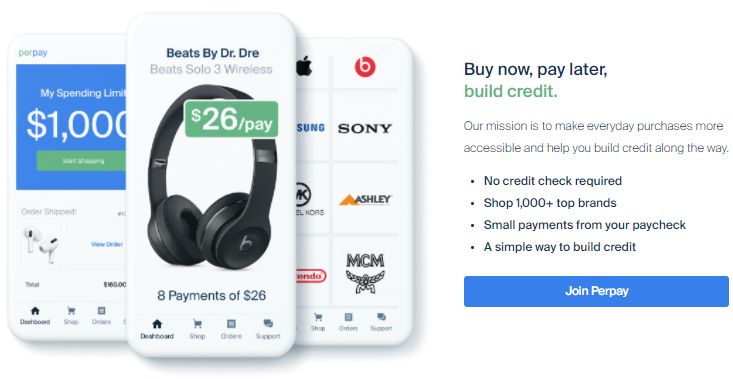

Perpay

Another Sezzle alternative you can try is Perpay. As a BNPL provider, Perpay takes a comparatively simple approach. Perpay’s website is extremely minimalistic and contains only a few details about its services.

Another Sezzle alternative you can try is Perpay. As a BNPL provider, Perpay takes a comparatively simple approach. Perpay’s website is extremely minimalistic and contains only a few details about its services.

You can also apply for a Perpay credit line based on your bank information and direct deposit. A Perpay credit line can be used for practically anything. Upon payment, your bank account will be debited weekly in installments from the company.

On its website, Perpay offers a shop where you can buy products from brands such as Nintendo, Apple, Samsung, and a lot more. Products are shipped quickly and the process is relatively simple.

Nevertheless, Perpay has the benefit of building credit for you as well. A $2 monthly fee is charged for this service called Perpay+, and you are enrolled in a credit-building program to help you improve your credit score.

It doesn’t matter if your credit score is bad or if you’re just starting out, Perpay is the way to go. With this program, users will be able to enjoy relaxed payment terms and build credit at the same time.

It is mandatory for all users to get PerPay account approval and be allocated a spending limit. The spending limit can be increased for users who pay on time.

Splitit

Splitit offers a lot of advantages, including no credit check, no interest rates, zero late fees, and fast approval. There are a variety of reasons why Splitit is one of the popular borrowing apps like Sezzle. Applying for splitit account is simple, and there is no interest or late fee.

Splitit offers a lot of advantages, including no credit check, no interest rates, zero late fees, and fast approval. There are a variety of reasons why Splitit is one of the popular borrowing apps like Sezzle. Applying for splitit account is simple, and there is no interest or late fee.

You need a credit or debit card in order to sign up for Splitit. By using your credit card or debit card, you authorize your payments and reserve the amount.

There are 3, 6, 12, and 24 installment options available. Your credit card can also be charged automatically every month if you choose to do so. Furthermore, Splitit does not impact your credit score, so it is a perfect option. Splitit is not available for in-store use; it can only be used online.

Using Splitit is a simple process, which allows customers to pay with their credit cards, and pay for those purchases in monthly interest-free installments. With Splitit, you can do this without registering or applying. The process is straightforward. It is possible for customers to spread their payments over time by using their existing credit cards.

In contrast to companies similar to Sezzle, Splitit provides the option to pay your installments early. Even though Splitit does not charge late fees, there will be interest imposed on late payments at your credit card’s APR. In order to avoid penalties and interest, try to pay early or on time.

Afterpay

Since its launch in 2014, Afterpay has become a well-known buy now, pay later platform. The company provides users with the option of making four interest-free payments. Moreover, there is no “downpayment” to make; rather, the cost is divided into four equal payments to be paid over a six-week period.

Since its launch in 2014, Afterpay has become a well-known buy now, pay later platform. The company provides users with the option of making four interest-free payments. Moreover, there is no “downpayment” to make; rather, the cost is divided into four equal payments to be paid over a six-week period.

Furthermore, Afterpay has become increasingly popular with retailers, allowing them to set smart credit limits, and allowing customers to control the payment process. Rather than paying upfront for a big order, you can split the cost into four equal payments with Afterpay.

Also Read: –

- 16 Best Sites Like Afterpay (Alternatives with No Credit Check)

- How to Delete Afterpay Account (Easy Guide)

Furthermore, you will not be subjected to a credit check. The maximum spending for a new user is $500. Using Afterpay, however, requires a credit or debit card, as well as the age of 18. There is also a $35 minimum purchase amount.

Instant approval makes it suitable for people with low credit scores, or for those who are typically unable to obtain credit.

There are over 3,300 retailers that accept Afterpay in the United States. With it, you can pay for your big purchases in installments over a 36-month period. The interest rates range between 10-30% APR.

In the event you cannot pay within six weeks, you will be charged a late fee ($8 per week) and your account will be closed. In general, however, the late fee will not exceed 25% of the transaction price. A number of regions are served by the company: Australia, UK, USA, Canada, and New Zealand.

PayPal Credit

Yet another Sezzle alternative that helps buyers pay off their purchases over a longer time is PayPal Credit. This is a service that offers customers loans to purchase goods and services. This essentially means you can use your PayPal account as a digital credit card. In the same way as a credit card, if you pay your balance in full within a certain timeframe, there will be no interest.

Yet another Sezzle alternative that helps buyers pay off their purchases over a longer time is PayPal Credit. This is a service that offers customers loans to purchase goods and services. This essentially means you can use your PayPal account as a digital credit card. In the same way as a credit card, if you pay your balance in full within a certain timeframe, there will be no interest.

When you make purchases of a minimum of $150, you will qualify for a four-month interest-free period – just pay your minimum monthly payments.

PayPal Credit allows you to shop anywhere they accept PayPal, and purchases over $99 will be eligible for 6 months of financing.

PayPal Credit can be used for a wide range of purchases. You don’t need to make a specific purchase to use PayPal Credit. It is up to you what you do with the money.

If your credit is approved, it will be applied automatically. Simply select “PayPal” on any website accepting PayPal as a payment method. The next step is to select whether you’d like to pay with your PayPal balance or request credit.

It won’t take you long to find out if your credit request has been approved. Your credit request will be approved within a few seconds. Upon approval, the funds are transferred directly into your PayPal account, allowing you to complete any purchases immediately without delay.

As you make a purchase using PayPal Credit and your credit limit would be exceeded, PayPal Credit will examine whether it can provide you with an increase in credit limit, enabling you to complete the purchase.

For purchases under $99, PayPal still gives you the option to borrow money without interest. You must pay the full amount due before the due date indicated on your statement. You’ll receive an email reminder from PayPal before your next payment is due, to make sure you don’t forget.

Fortunately, you won’t have to incur a membership fee or annul fee when using your PayPal credit line. You will, however, be charged late fees if your payment is not made on time.

Zip (Quadpay)

Formerly QuadPay, Zip uses a typical “Pay in 4” approach that’s common among other buy now pay later companies like Sezzle. Using this service, you can divide your payment into four equal installments and pay no interest.

Formerly QuadPay, Zip uses a typical “Pay in 4” approach that’s common among other buy now pay later companies like Sezzle. Using this service, you can divide your payment into four equal installments and pay no interest.

To begin with, you must download the app. Once you have found a store you like, browse the products, and you can choose “Pay with Zip” on the payment page. Upon selecting the option, the app automatically enters your payment information.

Also Read: –

- Zip (Quadpay) Alternatives: 17 Best Sites & Apps Like Zip Quadpay

- How to Delete Zip Account (EASY GUIDE)

Payment can be made in-store by selecting the “in-store” section of the app. If you want to use Zip at Checkout, look for the Zip payment mode at participating retailers.

Zip charges a convenience fee of $1 for every payment you make. Furthermore, your application gets approved instantly (the company doesn’t conduct hard checks).

If you’re late, you’ll be charged $5, $7, or $10, depending on where you live. Your credit card may also charge you interest or a late fee.

FuturePay

Although FuturePay is a credit solution designed exclusively for online retailers, it provides ease and convenience for both consumers and businesses. FuturePay was founded in 2013. In addition to helping businesses manage payments, FuturePay helps them expand as well, covering full costs for items purchased, allowing the customer to pay over time.

Although FuturePay is a credit solution designed exclusively for online retailers, it provides ease and convenience for both consumers and businesses. FuturePay was founded in 2013. In addition to helping businesses manage payments, FuturePay helps them expand as well, covering full costs for items purchased, allowing the customer to pay over time.

By offering mobile compatibility, easy navigation, streamlined checkout, and payment options, customers can shop wherever they are, make payments over time in installments, and even purchase items without cash, since they can pay later.

Partial.ly

Partial.ly was founded in 2015. Providing services to businesses in 25 countries and accepting over 135 currencies, the platform is quickly growing, assisting buyers in spreading large payments into more manageable, less financially burdensome installments.

Partial.ly was founded in 2015. Providing services to businesses in 25 countries and accepting over 135 currencies, the platform is quickly growing, assisting buyers in spreading large payments into more manageable, less financially burdensome installments.

It allows business owners to sell their goods or services through custom and flexible payment plans. Partial.ly integrates with a variety of popular e-commerce platforms, allowing businesses to simplify invoices and increase cash flow.

The ability to automate payments, flexible customizable payment options, easy signup process, and no monthly fees, make Partial.ly one of the most popular alternatives to Sezzle.

Fingerhut

With Fingerhut, you can shop online, make payments in installments, and build your credit. Fingerhut offers a range of products, from electronics to bedding to automobile parts, which can be purchased and financed using Fingerhut’s own credit line.

With Fingerhut, you can shop online, make payments in installments, and build your credit. Fingerhut offers a range of products, from electronics to bedding to automobile parts, which can be purchased and financed using Fingerhut’s own credit line.

As Fingerhut caters to applicants with a mediocre or poor credit history, it might be easier for applicants to qualify with Fingerhut compared to some major apps like Sezzle.

However, in contrast to other websites like Sezzle, Fingerhut credit can only be used to buy items from Fingerhut or authorized partners. Moreover, you’ll have to deal with extremely high pricing and interest rates.

You will be reported to all three major credit bureaus for making timely payments, which benefits your credit score building.

Zebit

Zebit lets shoppers find exactly what they are looking for. The company offers interest-free payment terms for most purchases up to six months and offers credit lines starting at $2,500 without an annual fee or other hidden fees. Zebit offers great prices as well; many of the products cost less than $100, making it the perfect destination for anyone interested in shopping.

Zebit lets shoppers find exactly what they are looking for. The company offers interest-free payment terms for most purchases up to six months and offers credit lines starting at $2,500 without an annual fee or other hidden fees. Zebit offers great prices as well; many of the products cost less than $100, making it the perfect destination for anyone interested in shopping.

Zebit stores everything you need for your gadgets under one roof. From clothing to jewelry to sports equipment and other products, Zebit provides a no-fee, interest-free payment plan available to people with bad credit.

Basically, ZebitLine is how much credit you have to finance products. Your payments will be split across six months by monthly payments. However, similar to other websites like Sezzle the credit amount varies based on your eligibility.

Best Sezzle Alternative

So, these are some of the top Sezzle like apps you can try out. Overviews of each app help you find the right app for your needs. Our choice for the best alternative to Sezzle will be AfterPay.

When you shop online, the buy-now and pay-later feature can make the process of purchasing easier. Be sure to familiarize yourself with the terms and conditions of the service you’re using.

Customers who require a longer payment period to handle big expenses will find BNPL apps (buy now pay later apps) useful. Go through the above apps, and tell us which one you like best through a comment below.